Page 115 - EXIM_AR2021

P. 115

ANNUAL REPORT 2021 113

Notes to the fiNaNcial statemeNts

2. significant accOUnting POlicies (cOnt’D.)

2.4 Summary of significant accounting policies (cont’d.)

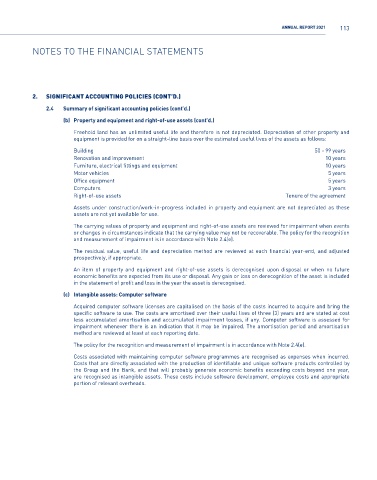

(b) Property and equipment and right-of-use assets (cont’d.)

Freehold land has an unlimited useful life and therefore is not depreciated. Depreciation of other property and

equipment is provided for on a straight-line basis over the estimated useful lives of the assets as follows:

Building 50 - 99 years

Renovation and improvement 10 years

Furniture, electrical fittings and equipment 10 years

Motor vehicles 5 years

Office equipment 5 years

Computers 3 years

Right-of-use assets Tenure of the agreement

Assets under construction/work-in-progress included in property and equipment are not depreciated as these

assets are not yet available for use.

The carrying values of property and equipment and right-of-use assets are reviewed for impairment when events

or changes in circumstances indicate that the carrying value may not be recoverable. The policy for the recognition

and measurement of impairment is in accordance with Note 2.4(e).

The residual value, useful life and depreciation method are reviewed at each financial year-end, and adjusted

prospectively, if appropriate.

An item of property and equipment and right-of-use assets is derecognised upon disposal or when no future

economic benefits are expected from its use or disposal. Any gain or loss on derecognition of the asset is included

in the statement of profit and loss in the year the asset is derecognised.

(c) Intangible assets: Computer software

Acquired computer software licenses are capitalised on the basis of the costs incurred to acquire and bring the

specific software to use. The costs are amortised over their useful lives of three (3) years and are stated at cost

less accumulated amortisation and accumulated impairment losses, if any. Computer software is assessed for

impairment whenever there is an indication that it may be impaired. The amortisation period and amortisation

method are reviewed at least at each reporting date.

The policy for the recognition and measurement of impairment is in accordance with Note 2.4(e).

Costs associated with maintaining computer software programmes are recognised as expenses when incurred.

Costs that are directly associated with the production of identifiable and unique software products controlled by

the Group and the Bank, and that will probably generate economic benefits exceeding costs beyond one year,

are recognised as intangible assets. These costs include software development, employee costs and appropriate

portion of relevant overheads.