Page 7 - EXIM-Bank_Annual-Report-2022

P. 7

ENSURING

FINANCIAL

COMMITMENT

ENHANCING

EMPOWERING

A VISION

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

GOVERNANCE

SUSTAINABILITY

GROWTH

LEAD

TO

STATEMENTS

TO SERVE

TO SERVE TO LEAD GROWTH SUST AINABILITY GOVERNANCE ST A TEMENTS 5 5

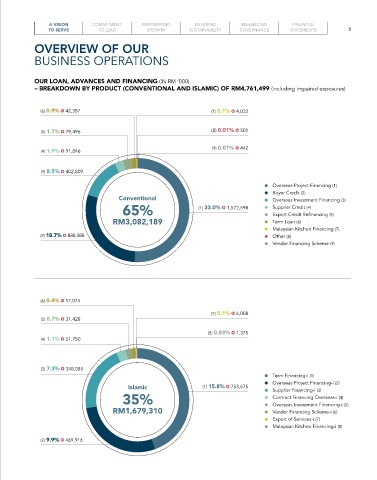

OVERVIEW OF OUR

BUSINESS OPERATIONS

OUR LOAN, ADVANCES AND FINANCING (IN RM ‘000)

– BREAKDOWN BY PRODUCT (CONVENTIONAL AND ISLAMIC) OF RM4,761,499 (including impaired exposures)

(6) 0.9% 42,387 (7) 0.1% 4,022

(5) 1.7% 79,496 (8) 0.01% 501

(9) 0.01% 442

(4) 1.9% 91,846

(3) 8.5% 402,809

Overseas Project Financing (1)

Buyer Credit (2)

Conventional Overseas Investment Financing (3)

65% (1) 33.0% 1,572,598 Supplier Credit (4)

Export Credit Refinancing (5)

RM3,082,189 Term Loan (6)

Malaysian Kitchen Financing (7)

(2) 18.7% 888,088 Other (8)

Vendor Financing Scheme (9)

(6) 0.4% 17,074

(7) 0.1% 6,008

(5) 0.7% 31,428

(8) 0.03% 1,375

(4) 1.1% 51,750

(3) 7.3% 348,085

Term Financing-i (1)

Overseas Project Financing-i (2)

Islamic (1) 15.8% 753,675

Supplier Financing-i (3)

35% Contract Financing Overseas-i (4)

Overseas Investment Financing-i (5)

RM1,679,310 Vendor Financing Scheme-i (6)

Export of Services-i (7)

Malaysian Kitchen Financing-i (8)

(2) 9.9% 469,916