Page 209 - EXIM-BANK-AR20

P. 209

Section 06 Financial Statements

207

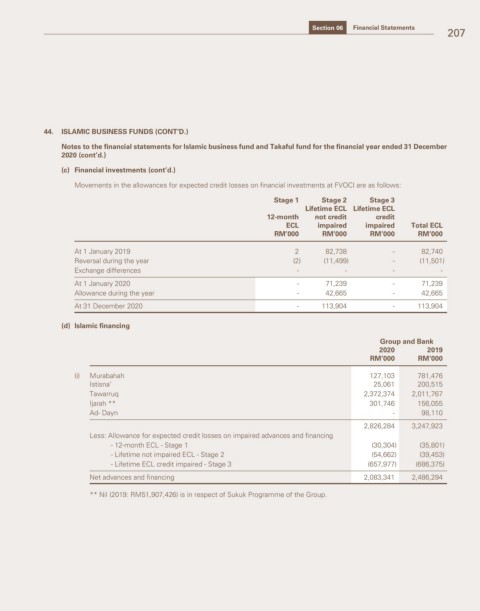

44. ISLAMIC BUSINESS FUNDS (CONT’D.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2020 (cont’d.)

(c) Financial investments (cont’d.)

Movements in the allowances for expected credit losses on financial investments at FVOCI are as follows:

Stage 1 Stage 2 Stage 3

Lifetime ECL Lifetime ECL

12-month not credit credit

ECL impaired impaired Total ECL

RM’000 RM’000 RM’000 RM’000

At 1 January 2019 2 82,738 - 82,740

Reversal during the year (2) (11,499) - (11,501)

Exchange differences - - - -

At 1 January 2020 - 71,239 - 71,239

Allowance during the year - 42,665 - 42,665

At 31 December 2020 - 113,904 - 113,904

(d) Islamic financing

Group and Bank

2020 2019

RM’000 RM’000

(i) Murabahah 127,103 781,476

Istisna’ 25,061 200,515

Tawarruq 2,372,374 2,011,767

Ijarah ** 301,746 156,055

Ad- Dayn - 98,110

2,826,284 3,247,923

Less: Allowance for expected credit losses on impaired advances and financing

- 12-month ECL - Stage 1 (30,304) (35,801)

- Lifetime not impaired ECL - Stage 2 (54,662) (39,453)

- Lifetime ECL credit impaired - Stage 3 (657,977) (686,375)

Net advances and financing 2,083,341 2,486,294

** Nil (2019: RM51,907,426) is in respect of Sukuk Programme of the Group.