Page 114 - Exim iar24_Ebook

P. 114

EXIM BANK MALAYSIA

112

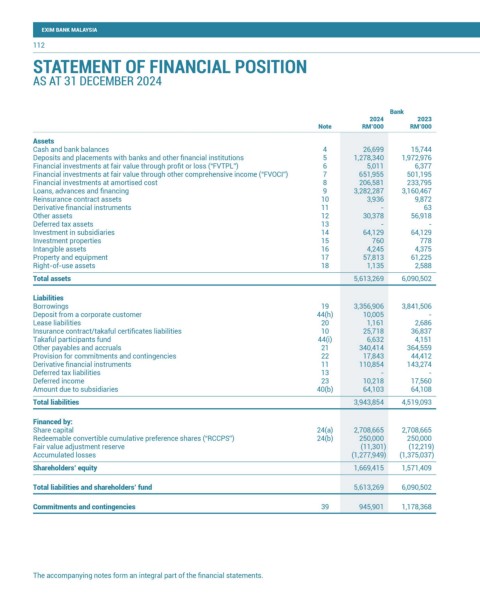

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2024

Bank

2024 2023

Note RM’000 RM’000

Assets

Cash and bank balances 4 26,699 15,744

Deposits and placements with banks and other financial institutions 5 1,278,340 1,972,976

Financial investments at fair value through profit or loss (“FVTPL”) 6 5,011 6,377

Financial investments at fair value through other comprehensive income (“FVOCI”) 7 651,955 501,195

Financial investments at amortised cost 8 206,581 233,795

Loans, advances and financing 9 3,282,287 3,160,467

Reinsurance contract assets 10 3,936 9,872

Derivative financial instruments 11 - 63

Other assets 12 30,378 56,918

Deferred tax assets 13 - -

Investment in subsidiaries 14 64,129 64,129

Investment properties 15 760 778

Intangible assets 16 4,245 4,375

Property and equipment 17 57,813 61,225

Right-of-use assets 18 1,135 2,588

Total assets 5,613,269 6,090,502

Liabilities

Borrowings 19 3,356,906 3,841,506

Deposit from a corporate customer 44(h) 10,005 -

Lease liabilities 20 1,161 2,686

Insurance contract/takaful certificates liabilities 10 25,718 36,837

Takaful participants fund 44(i) 6,632 4,151

Other payables and accruals 21 340,414 364,559

Provision for commitments and contingencies 22 17,843 44,412

Derivative financial instruments 11 110,854 143,274

Deferred tax liabilities 13 - -

Deferred income 23 10,218 17,560

Amount due to subsidiaries 40(b) 64,103 64,108

Total liabilities 3,943,854 4,519,093

Financed by:

Share capital 24(a) 2,708,665 2,708,665

Redeemable convertible cumulative preference shares (“RCCPS”) 24(b) 250,000 250,000

Fair value adjustment reserve (11,301) (12,219)

Accumulated losses (1,277,949) (1,375,037)

Shareholders’ equity 1,669,415 1,571,409

Total liabilities and shareholders’ fund 5,613,269 6,090,502

Commitments and contingencies 39 945,901 1,178,368

The accompanying notes form an integral part of the financial statements.