Page 148 - EXIM-Bank_Annual-Report-2022

P. 148

146 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

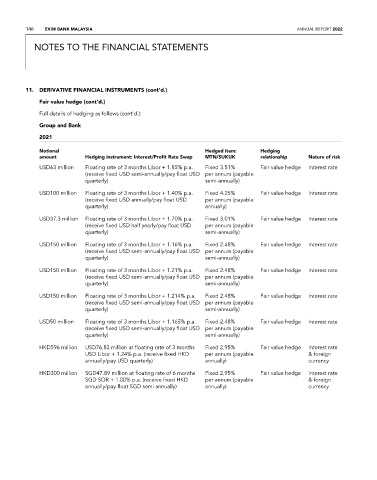

11. DerIvAtIve FINANCIAL INstruMeNts (cont’d.)

Fair value hedge (cont’d.)

Full details of hedging as follows (cont’d.):

Group and Bank

2021

Notional hedged item: hedging

amount Hedging instrument: Interest/Profit Rate Swap MTN/SUkUk relationship Nature of risk

USD63 million Floating rate of 3 months Libor + 1.85% p.a. Fixed 3.51% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD100 million Floating rate of 3 months Libor + 1.40% p.a. Fixed 4.25% Fair value hedge Interest rate

(receive fixed USD annually/pay float USD per annum (payable

quarterly) annually)

USD37.3 million Floating rate of 3 months Libor + 1.70% p.a. Fixed 3.01% Fair value hedge Interest rate

(receive fixed USD half yearly/pay float USD per annum (payable

quarterly) semi-annually)

USD150 million Floating rate of 3 months Libor + 1.16% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD150 million Floating rate of 3 months Libor + 1.21% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD150 million Floating rate of 3 months Libor + 1.214% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

USD50 million Floating rate of 3 months Libor + 1.165% p.a. Fixed 2.48% Fair value hedge Interest rate

(receive fixed USD semi-annually/pay float USD per annum (payable

quarterly) semi-annually)

HKD596 million USD76.83 million at floating rate of 3 months Fixed 2.95% Fair value hedge Interest rate

USD Libor + 1.24% p.a. (receive fixed HKD per annum (payable & foreign

annually/pay USD quarterly) annually) currency

HKD300 million SGD47.89 million at floating rate of 6 months Fixed 2.95% Fair value hedge Interest rate

SGD SOR + 1.00% p.a. (receive fixed HKD per annum (payable & foreign

annually/pay float SGD semi annually) annually) currency