Page 83 - EXIM-Bank_Annual-Report-2023

P. 83

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 81

STATEMENT OF

RiSK MANAGEMENT

RISK MAnAGEMEnt FRAMEwoRK ovERvIEw

The Bank’s risk management strategy has evolved over the years to support the Bank’s risk related decision-making, while balancing

the appropriate level of risk taken to the desired level of rewards.

The Bank has implemented an effective risk management framework, which identifies, assesses and manages various types of

risk that could impact our business objectives. Our risk management framework is designed to enable proactive identification of

potential risks, primarily the enterprise risk categories, risk governance and the development of strategies to mitigate them through

broad risk management approaches and specific risk management tools.

The Bank has a dedicated risk management function to manage risks through the process of identifying, measuring, monitoring

and controlling the primary enterprise risk categories, as well as timely reporting and updating of action plans on the risk findings.

These are governed by a structured risk governance mechanism consisting of strong Board and Management oversight roles and

responsibilities.

Our risk management framework is integrated into our business processes and culture, and it is reviewed and updated regularly

as reflected through the regular review of other risk related frameworks, policies, procedures and manuals to support risk related

decision-making; and to ensure that the Bank is able to provide swift and appropriate response to any internal, as well as external

changes, which will have an impact on the Bank’s operating environment.

Our risk management framework involves the following steps:

a. Establishment and review of the risk appetite approved by the Board.

b. Formulation of risk limits covering all relevant and material risks.

c. Establishment of effective risk identification, assessment, monitoring, mitigation and reporting processes.

d. Development of risk methodology and models supported by a robust model validation process.

The risk management function is regularly assessed to provide assurance on the Bank’s compliance to the applicable laws,

regulations, internal policies, procedures and limits.

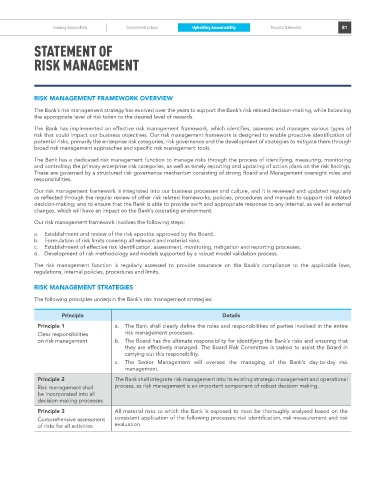

RISK MAnAGEMEnt StRAtEGIES

The following principles underpin the Bank’s risk management strategies:

Principle Details

Principle 1 a. The Bank shall clearly define the roles and responsibilities of parties involved in the entire

Clear responsibilities risk management processes.

on risk management b. The Board has the ultimate responsibility for identifying the Bank’s risks and ensuring that

they are effectively managed. The Board Risk Committee is tasked to assist the Board in

carrying out this responsibility.

c. The Senior Management will oversee the managing of the Bank’s day-to-day risk

management.

Principle 2 The Bank shall integrate risk management into its existing strategic management and operational

Risk management shall process, as risk management is an important component of robust decision making.

be incorporated into all

decision-making processes

Principle 3 All material risks to which the Bank is exposed to must be thoroughly analysed based on the

Comprehensive assessment consistent application of the following processes: risk identification, risk measurement and risk

of risks for all activities evaluation.