Page 139 - EXIM-BANK-AR20

P. 139

Section 06 Financial Statements

137

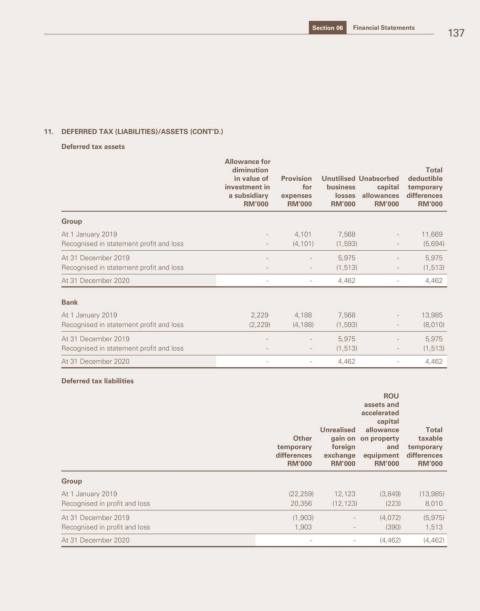

11. DEFERRED TAX (LIABILITIES)/ASSETS (CONT’D.)

Deferred tax assets

Allowance for

diminution Total

in value of Provision Unutilised Unabsorbed deductible

investment in for business capital temporary

a subsidiary expenses losses allowances differences

RM’000 RM’000 RM’000 RM’000 RM’000

Group

At 1 January 2019 - 4,101 7,568 - 11,669

Recognised in statement profit and loss - (4,101) (1,593) - (5,694)

At 31 December 2019 - - 5,975 - 5,975

Recognised in statement profit and loss - - (1,513) - (1,513)

At 31 December 2020 - - 4,462 - 4,462

Bank

At 1 January 2019 2,229 4,188 7,568 - 13,985

Recognised in statement profit and loss (2,229) (4,188) (1,593) - (8,010)

At 31 December 2019 - - 5,975 - 5,975

Recognised in statement profit and loss - - (1,513) - (1,513)

At 31 December 2020 - - 4,462 - 4,462

Deferred tax liabilities

ROU

assets and

accelerated

capital

Unrealised allowance Total

Other gain on on property taxable

temporary foreign and temporary

differences exchange equipment differences

RM’000 RM’000 RM’000 RM’000

Group

At 1 January 2019 (22,259) 12,123 (3,849) (13,985)

Recognised in profit and loss 20,356 (12,123) (223) 8,010

At 31 December 2019 (1,903) - (4,072) (5,975)

Recognised in profit and loss 1,903 - (390) 1,513

At 31 December 2020 - - (4,462) (4,462)