Page 141 - EXIM-BANK-AR20

P. 141

Section 06 Financial Statements

139

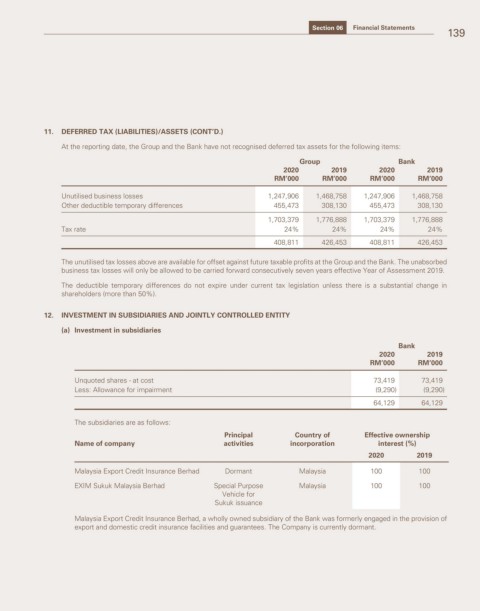

11. DEFERRED TAX (LIABILITIES)/ASSETS (CONT’D.)

At the reporting date, the Group and the Bank have not recognised deferred tax assets for the following items:

Group Bank

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Unutilised business losses 1,247,906 1,468,758 1,247,906 1,468,758

Other deductible temporary differences 455,473 308,130 455,473 308,130

1,703,379 1,776,888 1,703,379 1,776,888

Tax rate 24% 24% 24% 24%

408,811 426,453 408,811 426,453

The unutilised tax losses above are available for offset against future taxable profits at the Group and the Bank. The unabsorbed

business tax losses will only be allowed to be carried forward consecutively seven years effective Year of Assessment 2019.

The deductible temporary differences do not expire under current tax legislation unless there is a substantial change in

shareholders (more than 50%).

12. INVESTMENT IN SUBSIDIARIES AND JOINTLY CONTROLLED ENTITY

(a) Investment in subsidiaries

Bank

2020 2019

RM’000 RM’000

Unquoted shares - at cost 73,419 73,419

Less: Allowance for impairment (9,290) (9,290)

64,129 64,129

The subsidiaries are as follows:

Principal Country of Effective ownership

Name of company activities incorporation interest (%)

2020 2019

Malaysia Export Credit Insurance Berhad Dormant Malaysia 100 100

EXIM Sukuk Malaysia Berhad Special Purpose Malaysia 100 100

Vehicle for

Sukuk issuance

Malaysia Export Credit Insurance Berhad, a wholly owned subsidiary of the Bank was formerly engaged in the provision of

export and domestic credit insurance facilities and guarantees. The Company is currently dormant.