Page 147 - EXIM-BANK-AR20

P. 147

Section 06 Financial Statements

145

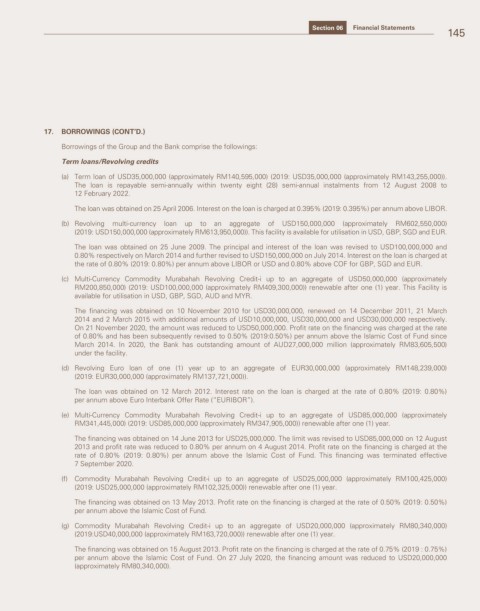

17. BORROWINGS (CONT’D.)

Borrowings of the Group and the Bank comprise the followings:

Term loans/Revolving credits

(a) Term loan of USD35,000,000 (approximately RM140,595,000) (2019: USD35,000,000 (approximately RM143,255,000)).

The loan is repayable semi-annually within twenty eight (28) semi-annual instalments from 12 August 2008 to

12 February 2022.

The loan was obtained on 25 April 2006. Interest on the loan is charged at 0.395% (2019: 0.395%) per annum above LIBOR.

(b) Revolving multi-currency loan up to an aggregate of USD150,000,000 (approximately RM602,550,000)

(2019: USD150,000,000 (approximately RM613,950,000)). This facility is available for utilisation in USD, GBP, SGD and EUR.

The loan was obtained on 25 June 2009. The principal and interest of the loan was revised to USD100,000,000 and

0.80% respectively on March 2014 and further revised to USD150,000,000 on July 2014. Interest on the loan is charged at

the rate of 0.80% (2019: 0.80%) per annum above LIBOR or USD and 0.80% above COF for GBP, SGD and EUR.

(c) Multi-Currency Commodity Murabahah Revolving Credit-i up to an aggregate of USD50,000,000 (approximately

RM200,850,000) (2019: USD100,000,000 (approximately RM409,300,000)) renewable after one (1) year. This Facility is

available for utilisation in USD, GBP, SGD, AUD and MYR.

The financing was obtained on 10 November 2010 for USD30,000,000, renewed on 14 December 2011, 21 March

2014 and 2 March 2015 with additional amounts of USD10,000,000, USD30,000,000 and USD30,000,000 respectively.

On 21 November 2020, the amount was reduced to USD50,000,000. Profit rate on the financing was charged at the rate

of 0.80% and has been subsequently revised to 0.50% (2019:0.50%) per annum above the Islamic Cost of Fund since

March 2014. In 2020, the Bank has outstanding amount of AUD27,000,000 million (approximately RM83,605,500)

under the facility.

(d) Revolving Euro loan of one (1) year up to an aggregate of EUR30,000,000 (approximately RM148,239,000)

(2019: EUR30,000,000 (approximately RM137,721,000)).

The loan was obtained on 12 March 2012. Interest rate on the loan is charged at the rate of 0.80% (2019: 0.80%)

per annum above Euro Interbank Offer Rate (“EURIBOR”).

(e) Multi-Currency Commodity Murabahah Revolving Credit-i up to an aggregate of USD85,000,000 (approximately

RM341,445,000) (2019: USD85,000,000 (approximately RM347,905,000)) renewable after one (1) year.

The financing was obtained on 14 June 2013 for USD25,000,000. The limit was revised to USD85,000,000 on 12 August

2013 and profit rate was reduced to 0.80% per annum on 4 August 2014. Profit rate on the financing is charged at the

rate of 0.80% (2019: 0.80%) per annum above the Islamic Cost of Fund. This financing was terminated effective

7 September 2020.

(f) Commodity Murabahah Revolving Credit-i up to an aggregate of USD25,000,000 (approximately RM100,425,000)

(2019: USD25,000,000 (approximately RM102,325,000)) renewable after one (1) year.

The financing was obtained on 13 May 2013. Profit rate on the financing is charged at the rate of 0.50% (2019: 0.50%)

per annum above the Islamic Cost of Fund.

(g) Commodity Murabahah Revolving Credit-i up to an aggregate of USD20,000,000 (approximately RM80,340,000)

(2019:USD40,000,000 (approximately RM163,720,000)) renewable after one (1) year.

The financing was obtained on 15 August 2013. Profit rate on the financing is charged at the rate of 0.75% (2019 : 0.75%)

per annum above the Islamic Cost of Fund. On 27 July 2020, the financing amount was reduced to USD20,000,000

(approximately RM80,340,000).