Page 149 - EXIM-BANK-AR20

P. 149

Section 06 Financial Statements

147

17. BORROWINGS (CONT’D.)

Borrowings of the Group and the Bank comprise the followings: (cont’d.)

Term loans/Revolving credits (cont’d.)

(o) Revolving US Dollar loan up to a maximum facility of USD60,000,000 (approximately RM241,020,000).

(2019 : USD60,000,000 (approximately RM245,580,000)).

The loan was obtained on 9 January 2017. Interest on loan is charged at the rate of 0.80% (2019 : 0.80%) per annum

above LIBOR.

(p) Syndicated Term Financing Facility of USD300,000,000 (approximately RM1,205,100,000 (2019 : USD300,000,000

(approximately RM1,227,900,000)).

The loan was obtained on 5 November 2020 and repayable after a period of 4.5 years. Profit on the financing is charged

at 0.90% per annum above LIBOR.

(q) Revolving US Dollar loan up to a maximum facility of USD20,000,000 (approximately RM80,340,000).

The loan was obtained on 20 October 2020. Interest on loan is charged at the rate of 0.75% (2019 : 0.80%) per annum

above Cost of Fund.

(r) The fund from Bank Negara Malaysia (“BNM”) amounting to RM400,000 for the purpose to provide financing to SME

customers.

The placement is interest-free and commence from 6 March 2020 and expire on the repayment date.

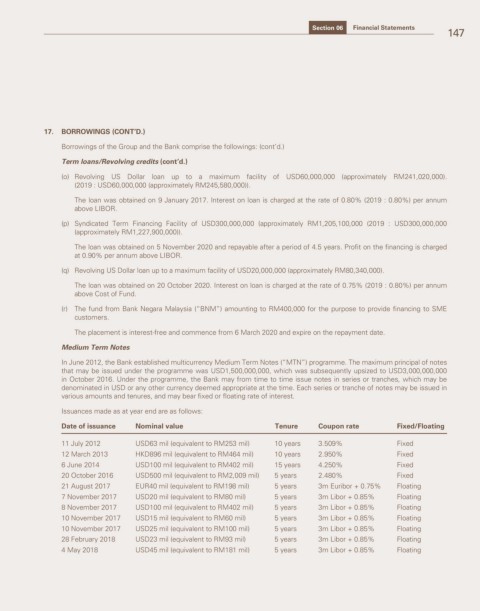

Medium Term Notes

In June 2012, the Bank established multicurrency Medium Term Notes (“MTN”) programme. The maximum principal of notes

that may be issued under the programme was USD1,500,000,000, which was subsequently upsized to USD3,000,000,000

in October 2016. Under the programme, the Bank may from time to time issue notes in series or tranches, which may be

denominated in USD or any other currency deemed appropriate at the time. Each series or tranche of notes may be issued in

various amounts and tenures, and may bear fixed or floating rate of interest.

Issuances made as at year end are as follows:

Date of issuance Nominal value Tenure Coupon rate Fixed/Floating

11 July 2012 USD63 mil (equivalent to RM253 mil) 10 years 3.509% Fixed

12 March 2013 HKD896 mil (equivalent to RM464 mil) 10 years 2.950% Fixed

6 June 2014 USD100 mil (equivalent to RM402 mil) 15 years 4.250% Fixed

20 October 2016 USD500 mil (equivalent to RM2,009 mil) 5 years 2.480% Fixed

21 August 2017 EUR40 mil (equivalent to RM198 mil) 5 years 3m Euribor + 0.75% Floating

7 November 2017 USD20 mil (equivalent to RM80 mil) 5 years 3m Libor + 0.85% Floating

8 November 2017 USD100 mil (equivalent to RM402 mil) 5 years 3m Libor + 0.85% Floating

10 November 2017 USD15 mil (equivalent to RM60 mil) 5 years 3m Libor + 0.85% Floating

10 November 2017 USD25 mil (equivalent to RM100 mil) 5 years 3m Libor + 0.85% Floating

28 February 2018 USD23 mil (equivalent to RM93 mil) 5 years 3m Libor + 0.85% Floating

4 May 2018 USD45 mil (equivalent to RM181 mil) 5 years 3m Libor + 0.85% Floating