Page 156 - EXIM-BANK-AR20

P. 156

154 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

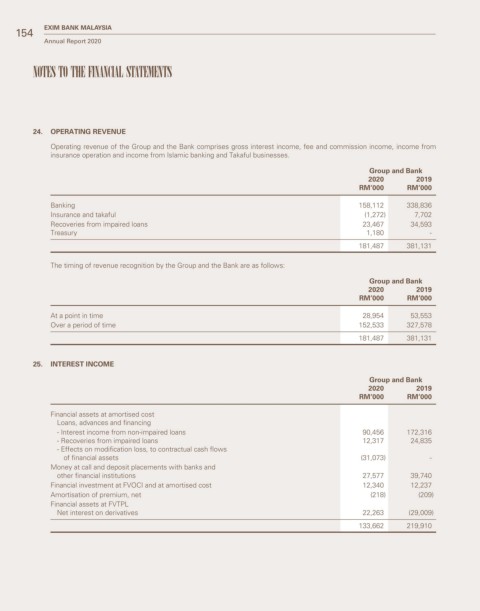

24. OPERATING REVENUE

Operating revenue of the Group and the Bank comprises gross interest income, fee and commission income, income from

insurance operation and income from Islamic banking and Takaful businesses.

Group and Bank

2020 2019

RM’000 RM’000

Banking 158,112 338,836

Insurance and takaful (1,272) 7,702

Recoveries from impaired loans 23,467 34,593

Treasury 1,180 -

181,487 381,131

The timing of revenue recognition by the Group and the Bank are as follows:

Group and Bank

2020 2019

RM’000 RM’000

At a point in time 28,954 53,553

Over a period of time 152,533 327,578

181,487 381,131

25. INTEREST INCOME

Group and Bank

2020 2019

RM’000 RM’000

Financial assets at amortised cost

Loans, advances and financing

- Interest income from non-impaired loans 90,456 172,316

- Recoveries from impaired loans 12,317 24,835

- Effects on modification loss, to contractual cash flows

of financial assets (31,073) -

Money at call and deposit placements with banks and

other financial institutions 27,577 39,740

Financial investment at FVOCI and at amortised cost 12,340 12,237

Amortisation of premium, net (218) (209)

Financial assets at FVTPL

Net interest on derivatives 22,263 (29,009)

133,662 219,910