Page 163 - EXIM-BANK-AR20

P. 163

Section 06 Financial Statements

161

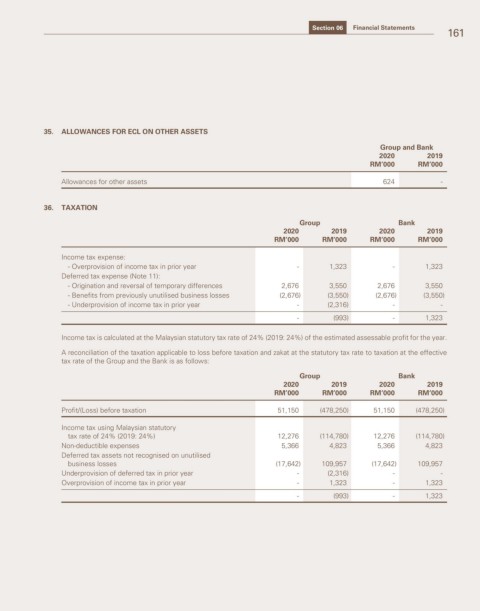

35. ALLOWANCES FOR ECL ON OTHER ASSETS

Group and Bank

2020 2019

RM’000 RM’000

Allowances for other assets 624 -

36. TAXATION

Group Bank

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Income tax expense:

- Overprovision of income tax in prior year - 1,323 - 1,323

Deferred tax expense (Note 11):

- Origination and reversal of temporary differences 2,676 3,550 2,676 3,550

- Benefits from previously unutilised business losses (2,676) (3,550) (2,676) (3,550)

- Underprovision of income tax in prior year - (2,316) - -

- (993) - 1,323

Income tax is calculated at the Malaysian statutory tax rate of 24% (2019: 24%) of the estimated assessable profit for the year.

A reconciliation of the taxation applicable to loss before taxation and zakat at the statutory tax rate to taxation at the effective

tax rate of the Group and the Bank is as follows:

Group Bank

2020 2019 2020 2019

RM’000 RM’000 RM’000 RM’000

Profit/(Loss) before taxation 51,150 (478,250) 51,150 (478,250)

Income tax using Malaysian statutory

tax rate of 24% (2019: 24%) 12,276 (114,780) 12,276 (114,780)

Non-deductible expenses 5,366 4,823 5,366 4,823

Deferred tax assets not recognised on unutilised

business losses (17,642) 109,957 (17,642) 109,957

Underprovision of deferred tax in prior year - (2,316) - -

Overprovision of income tax in prior year - 1,323 - 1,323

- (993) - 1,323