Page 167 - EXIM-BANK-AR20

P. 167

Section 06 Financial Statements

165

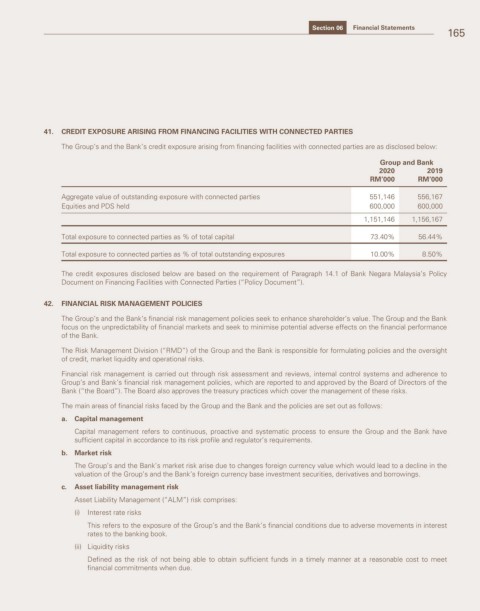

41. CREDIT EXPOSURE ARISING FROM FINANCING FACILITIES WITH CONNECTED PARTIES

The Group’s and the Bank’s credit exposure arising from financing facilities with connected parties are as disclosed below:

Group and Bank

2020 2019

RM’000 RM’000

Aggregate value of outstanding exposure with connected parties 551,146 556,167

Equities and PDS held 600,000 600,000

1,151,146 1,156,167

Total exposure to connected parties as % of total capital 73.40% 56.44%

Total exposure to connected parties as % of total outstanding exposures 10.00% 8.50%

The credit exposures disclosed below are based on the requirement of Paragraph 14.1 of Bank Negara Malaysia’s Policy

Document on Financing Facilities with Connected Parties (“Policy Document”).

42. FINANCIAL RISK MANAGEMENT POLICIES

The Group’s and the Bank’s financial risk management policies seek to enhance shareholder’s value. The Group and the Bank

focus on the unpredictability of financial markets and seek to minimise potential adverse effects on the financial performance

of the Bank.

The Risk Management Division (“RMD”) of the Group and the Bank is responsible for formulating policies and the oversight

of credit, market liquidity and operational risks.

Financial risk management is carried out through risk assessment and reviews, internal control systems and adherence to

Group’s and Bank’s financial risk management policies, which are reported to and approved by the Board of Directors of the

Bank (“the Board”). The Board also approves the treasury practices which cover the management of these risks.

The main areas of financial risks faced by the Group and the Bank and the policies are set out as follows:

a. Capital management

Capital management refers to continuous, proactive and systematic process to ensure the Group and the Bank have

sufficient capital in accordance to its risk profile and regulator’s requirements.

b. Market risk

The Group’s and the Bank’s market risk arise due to changes foreign currency value which would lead to a decline in the

valuation of the Group’s and the Bank’s foreign currency base investment securities, derivatives and borrowings.

c. Asset liability management risk

Asset Liability Management (“ALM”) risk comprises:

(i) Interest rate risks

This refers to the exposure of the Group’s and the Bank’s financial conditions due to adverse movements in interest

rates to the banking book.

(ii) Liquidity risks

Defined as the risk of not being able to obtain sufficient funds in a timely manner at a reasonable cost to meet

financial commitments when due.