Page 170 - EXIM-BANK-AR20

P. 170

168 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

42. FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Capital monitoring

The Group’s and the Bank’s capital are closely monitored and actively managed. Besides the regulatory capital requirement of

8%, the Group and the Bank have set an internal capital requirement limit that would act as a buffer to the regulatory capital

and as an indicator that affords the Group and the Bank a “well capitalised” status. The MRC shall be responsible in managing

and monitoring both the internal capital limit and regulatory capital requirement.

Market risk management

Approach and risk strategy

The principal objectives of market risk management are to assume an appropriate balance between the level of risk and the

level of return desired in order to maximise the return to shareholders’ funds and to ensure prudent management of the

Group’s and the Bank’s resources to support the growth of the Group’s and the Bank’s economic value.

The Group’s and the Bank’s market risk management strategies are to identify, measure, monitor and manage the Group’s and

the Bank’s earnings and capital against market risk inherent in all activities of the Group and the Bank and ensure all relevant

personnel clearly understand the Group’s and the Bank’s approach in managing market risk.

Risk identification

The Group’s and the Bank’s market risk arise due to changes foreign currency which would lead to a decline in the value of

the Group’s and the Bank’s investment securities, derivatives, borrowings, foreign exchange and equity position.

Measurement

The Group’s and the Bank’s policies are to minimise the exposures to foreign currency risk arising from lending activities

by monitoring and obtaining the Board’s approval for funding requisitions that involve foreign currencies.

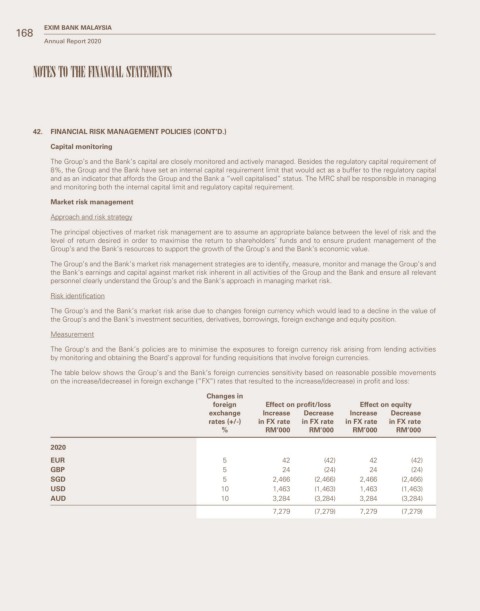

The table below shows the Group’s and the Bank’s foreign currencies sensitivity based on reasonable possible movements

on the increase/(decrease) in foreign exchange (“FX”) rates that resulted to the increase/(decrease) in profit and loss:

Changes in

foreign Effect on profit/loss Effect on equity

exchange Increase Decrease Increase Decrease

rates (+/-) in FX rate in FX rate in FX rate in FX rate

% RM’000 RM’000 RM’000 RM’000

2020

EUR 5 42 (42) 42 (42)

GBP 5 24 (24) 24 (24)

SGD 5 2,466 (2,466) 2,466 (2,466)

USD 10 1,463 (1,463) 1,463 (1,463)

AUD 10 3,284 (3,284) 3,284 (3,284)

7,279 (7,279) 7,279 (7,279)