Page 173 - EXIM-BANK-AR20

P. 173

Section 06 Financial Statements

171

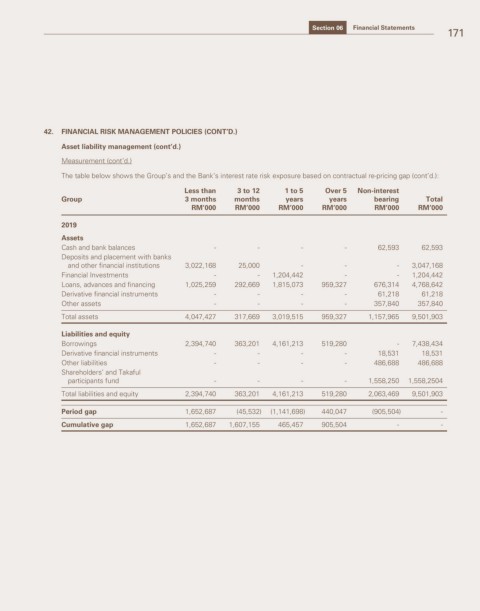

42. FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Asset liability management (cont’d.)

Measurement (cont’d.)

The table below shows the Group’s and the Bank’s interest rate risk exposure based on contractual re-pricing gap (cont’d.):

Less than 3 to 12 1 to 5 Over 5 Non-interest

Group 3 months months years years bearing Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2019

Assets

Cash and bank balances - - - - 62,593 62,593

Deposits and placement with banks

and other financial institutions 3,022,168 25,000 - - - 3,047,168

Financial Investments - - 1,204,442 - - 1,204,442

Loans, advances and financing 1,025,259 292,669 1,815,073 959,327 676,314 4,768,642

Derivative financial instruments - - - - 61,218 61,218

Other assets - - - - 357,840 357,840

Total assets 4,047,427 317,669 3,019,515 959,327 1,157,965 9,501,903

Liabilities and equity

Borrowings 2,394,740 363,201 4,161,213 519,280 - 7,438,434

Derivative financial instruments - - - - 18,531 18,531

Other liabilities - - - - 486,688 486,688

Shareholders’ and Takaful

participants fund - - - - 1,558,250 1,558,2504

Total liabilities and equity 2,394,740 363,201 4,161,213 519,280 2,063,469 9,501,903

Period gap 1,652,687 (45,532) (1,141,698) 440,047 (905,504) -

Cumulative gap 1,652,687 1,607,155 465,457 905,504 - -