Page 172 - EXIM-BANK-AR20

P. 172

170 EXIM BANK MALAYSIA

Annual Report 2020

NOTES TO THE FINANCIAL STATEMENTS

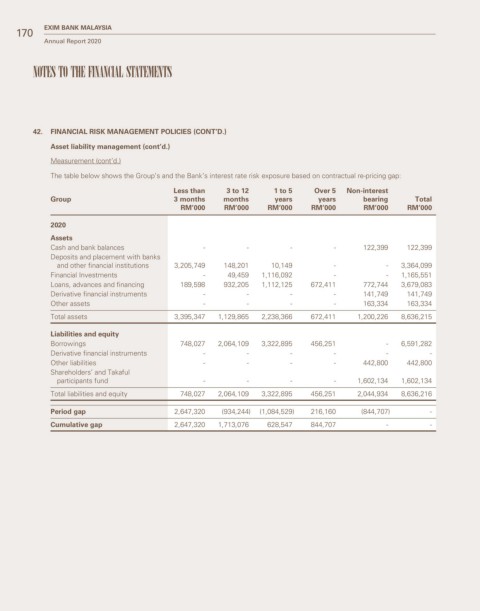

42. FINANCIAL RISK MANAGEMENT POLICIES (CONT’D.)

Asset liability management (cont’d.)

Measurement (cont’d.)

The table below shows the Group’s and the Bank’s interest rate risk exposure based on contractual re-pricing gap:

Less than 3 to 12 1 to 5 Over 5 Non-interest

Group 3 months months years years bearing Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2020

Assets

Cash and bank balances - - - - 122,399 122,399

Deposits and placement with banks

and other financial institutions 3,205,749 148,201 10,149 - - 3,364,099

Financial Investments - 49,459 1,116,092 - - 1,165,551

Loans, advances and financing 189,598 932,205 1,112,125 672,411 772,744 3,679,083

Derivative financial instruments - - - - 141,749 141,749

Other assets - - - - 163,334 163,334

Total assets 3,395,347 1,129,865 2,238,366 672,411 1,200,226 8,636,215

Liabilities and equity

Borrowings 748,027 2,064,109 3,322,895 456,251 - 6,591,282

Derivative financial instruments - - - - - -

Other liabilities - - - - 442,800 442,800

Shareholders’ and Takaful

participants fund - - - - 1,602,134 1,602,134

Total liabilities and equity 748,027 2,064,109 3,322,895 456,251 2,044,934 8,636,216

Period gap 2,647,320 (934,244) (1,084,529) 216,160 (844,707) -

Cumulative gap 2,647,320 1,713,076 628,547 844,707 - -