Page 221 - EXIM-BANK-AR20

P. 221

Section 06 Financial Statements

219

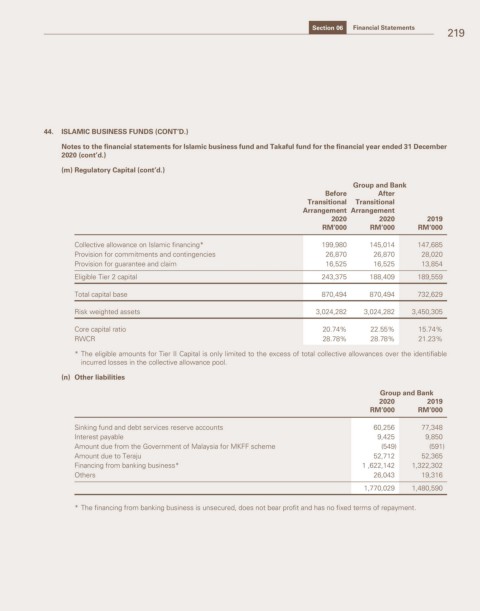

44. ISLAMIC BUSINESS FUNDS (CONT’D.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2020 (cont’d.)

(m) Regulatory Capital (cont’d.)

Group and Bank

Before After

Transitional Transitional

Arrangement Arrangement

2020 2020 2019

RM’000 RM’000 RM’000

Collective allowance on Islamic financing* 199,980 145,014 147,685

Provision for commitments and contingencies 26,870 26,870 28,020

Provision for guarantee and claim 16,525 16,525 13,854

Eligible Tier 2 capital 243,375 188,409 189,559

Total capital base 870,494 870,494 732,629

Risk weighted assets 3,024,282 3,024,282 3,450,305

Core capital ratio 20.74% 22.55% 15.74%

RWCR 28.78% 28.78% 21.23%

* The eligible amounts for Tier II Capital is only limited to the excess of total collective allowances over the identifiable

incurred losses in the collective allowance pool.

(n) Other liabilities

Group and Bank

2020 2019

RM’000 RM’000

Sinking fund and debt services reserve accounts 60,256 77,348

Interest payable 9,425 9,850

Amount due from the Government of Malaysia for MKFF scheme (549) (591)

Amount due to Teraju 52,712 52,365

Financing from banking business* 1 ,622,142 1,322,302

Others 26,043 19,316

1,770,029 1,480,590

* The financing from banking business is unsecured, does not bear profit and has no fixed terms of repayment.