Page 225 - EXIM-BANK-AR20

P. 225

Section 06 Financial Statements

223

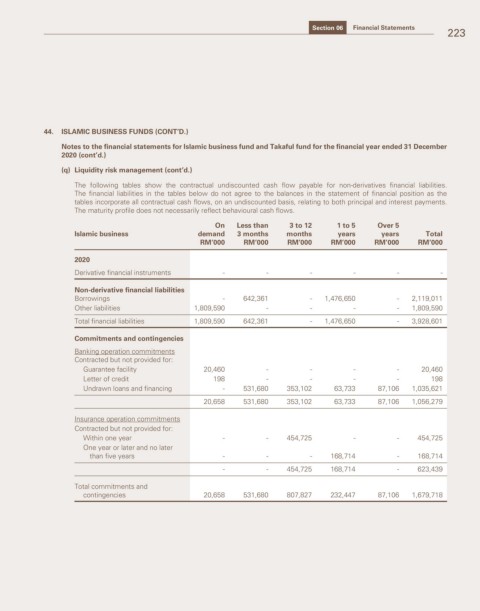

44. ISLAMIC BUSINESS FUNDS (CONT’D.)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December

2020 (cont’d.)

(q) Liquidity risk management (cont’d.)

The following tables show the contractual undiscounted cash flow payable for non-derivatives financial liabilities.

The financial liabilities in the tables below do not agree to the balances in the statement of financial position as the

tables incorporate all contractual cash flows, on an undiscounted basis, relating to both principal and interest payments.

The maturity profile does not necessarily reflect behavioural cash flows.

On Less than 3 to 12 1 to 5 Over 5

Islamic business demand 3 months months years years Total

RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2020

Derivative financial instruments - - - - - -

Non-derivative financial liabilities

Borrowings - 642,361 - 1,476,650 - 2,119,011

Other liabilities 1,809,590 - - - - 1,809,590

Total financial liabilities 1,809,590 642,361 - 1,476,650 - 3,928,601

Commitments and contingencies

Banking operation commitments

Contracted but not provided for:

Guarantee facility 20,460 - - - - 20,460

Letter of credit 198 - - - - 198

Undrawn loans and financing - 531,680 353,102 63,733 87,106 1,035,621

20,658 531,680 353,102 63,733 87,106 1,056,279

Insurance operation commitments

Contracted but not provided for:

Within one year - - 454,725 - - 454,725

One year or later and no later

than five years - - - 168,714 - 168,714

- - 454,725 168,714 - 623,439

Total commitments and

contingencies 20,658 531,680 807,827 232,447 87,106 1,679,718