Page 218 - Exim iar24_Ebook

P. 218

EXIM BANK MALAYSIA

216

NOTES TO THE FINANCIAL STATEMENTS

43. INSURANCE RISKS (cont’d)

Liability for remaining coverage (cont’d)

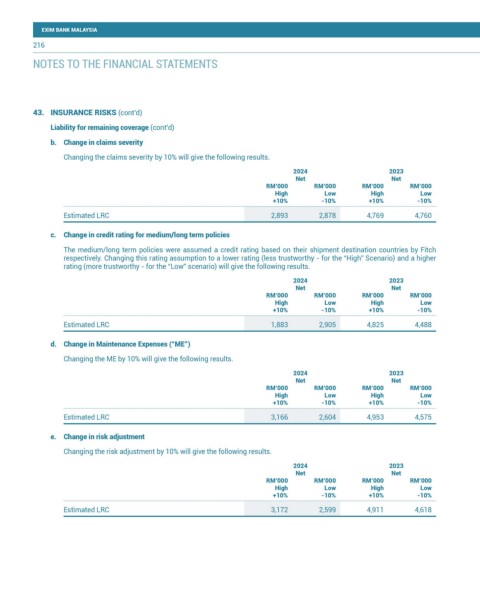

b. Change in claims severity

Changing the claims severity by 10% will give the following results.

2024 2023

Net Net

RM’000 RM’000 RM’000 RM’000

High Low High Low

+10% -10% +10% -10%

Estimated LRC 2,893 2,878 4,769 4,760

c. Change in credit rating for medium/long term policies

The medium/long term policies were assumed a credit rating based on their shipment destination countries by Fitch

respectively. Changing this rating assumption to a lower rating (less trustworthy - for the “High” Scenario) and a higher

rating (more trustworthy - for the “Low” scenario) will give the following results.

2024 2023

Net Net

RM’000 RM’000 RM’000 RM’000

High Low High Low

+10% -10% +10% -10%

Estimated LRC 1,883 2,905 4,825 4,488

d. Change in Maintenance Expenses (“ME”)

Changing the ME by 10% will give the following results.

2024 2023

Net Net

RM’000 RM’000 RM’000 RM’000

High Low High Low

+10% -10% +10% -10%

Estimated LRC 3,166 2,604 4,953 4,575

e. Change in risk adjustment

Changing the risk adjustment by 10% will give the following results.

2024 2023

Net Net

RM’000 RM’000 RM’000 RM’000

High Low High Low

+10% -10% +10% -10%

Estimated LRC 3,172 2,599 4,911 4,618