Page 36 - Exim iar24_Ebook

P. 36

EXIM BANK MALAYSIA

34

SUSTAINABILITY

JOURNEY

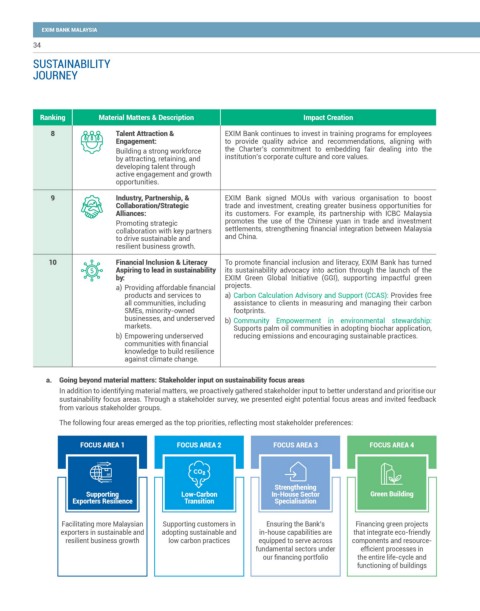

Ranking Material Matters & Description Impact Creation

8 Talent Attraction & EXIM Bank continues to invest in training programs for employees

Engagement: to provide quality advice and recommendations, aligning with

Building a strong workforce the Charter’s commitment to embedding fair dealing into the

by attracting, retaining, and institution’s corporate culture and core values.

developing talent through

active engagement and growth

opportunities.

9 Industry, Partnership, & EXIM Bank signed MOUs with various organisation to boost

Collaboration/Strategic trade and investment, creating greater business opportunities for

Alliances: its customers. For example, its partnership with ICBC Malaysia

Promoting strategic promotes the use of the Chinese yuan in trade and investment

collaboration with key partners settlements, strengthening financial integration between Malaysia

to drive sustainable and and China.

resilient business growth.

10 Financial Inclusion & Literacy To promote financial inclusion and literacy, EXIM Bank has turned

Aspiring to lead in sustainability its sustainability advocacy into action through the launch of the

by: EXIM Green Global Initiative (GGI), supporting impactful green

a) Providing affordable financial projects.

products and services to a) Carbon Calculation Advisory and Support (CCAS): Provides free

all communities, including assistance to clients in measuring and managing their carbon

SMEs, minority-owned footprints.

businesses, and underserved b) Community Empowerment in environmental stewardship:

markets. Supports palm oil communities in adopting biochar application,

b) Empowering underserved reducing emissions and encouraging sustainable practices.

communities with financial

knowledge to build resilience

against climate change.

a. Going beyond material matters: Stakeholder input on sustainability focus areas

In addition to identifying material matters, we proactively gathered stakeholder input to better understand and prioritise our

sustainability focus areas. Through a stakeholder survey, we presented eight potential focus areas and invited feedback

from various stakeholder groups.

The following four areas emerged as the top priorities, reflecting most stakeholder preferences:

FOCUS AREA 1 FOCUS AREA 2 FOCUS AREA 3 FOCUS AREA 4

Strengthening

Supporting Low-Carbon In-House Sector Green Building

Exporters Resilience Transition Specialisation

Facilitating more Malaysian Supporting customers in Ensuring the Bank’s Financing green projects

exporters in sustainable and adopting sustainable and in-house capabilities are that integrate eco-friendly

resilient business growth low carbon practices equipped to serve across components and resource-

fundamental sectors under efficient processes in

our financing portfolio the entire life-cycle and

functioning of buildings