Page 8 - Exim iar24_Ebook

P. 8

EXIM BANK MALAYSIA

6

OVERVIEW OF OUR BUSINESS OPERATIONS

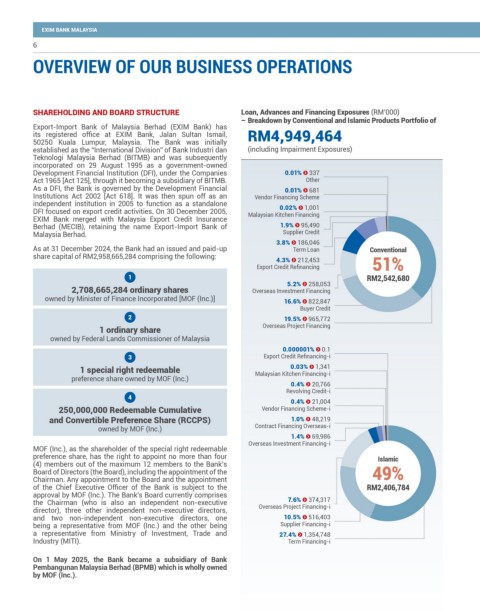

SHAREHOLDING AND BOARD STRUCTURE Loan, Advances and Financing Exposures (RM’000)

– Breakdown by Conventional and Islamic Products Portfolio of

Export-Import Bank of Malaysia Berhad (EXIM Bank) has

its registered office at EXIM Bank, Jalan Sultan Ismail, RM4,949,464

50250 Kuala Lumpur, Malaysia. The Bank was initially

established as the “International Division” of Bank Industri dan (including Impairment Exposures)

Teknologi Malaysia Berhad (BITMB) and was subsequently

incorporated on 29 August 1995 as a government-owned

Development Financial Institution (DFI), under the Companies 0.01% 337

Act 1965 [Act 125], through it becoming a subsidiary of BITMB. Other

As a DFI, the Bank is governed by the Development Financial 0.01% 681

Institutions Act 2002 [Act 618]. It was then spun off as an Vendor Financing Scheme

independent institution in 2005 to function as a standalone 0.02% 1,001

DFI focused on export credit activities. On 30 December 2005, Malaysian Kitchen Financing

EXIM Bank merged with Malaysia Export Credit Insurance

Berhad (MECIB), retaining the name Export-Import Bank of 1.9% 95,490

Malaysia Berhad. Supplier Credit

3.8% 186,046

As at 31 December 2024, the Bank had an issued and paid-up Term Loan Conventional

share capital of RM2,958,665,284 comprising the following: 4.3% 212,453

Export Credit Refinancing 51%

1 RM2,542,680

5.2% 258,053

2,708,665,284 ordinary shares Overseas Investment Financing

owned by Minister of Finance Incorporated [MOF (Inc.)] 16.6% 822,847

Buyer Credit

2 19.5% 965,772

1 ordinary share Overseas Project Financing

owned by Federal Lands Commissioner of Malaysia

0.000001% 0.1

3 Export Credit Refinancing-i

0.03% 1,341

1 special right redeemable Malaysian Kitchen Financing-i

preference share owned by MOF (Inc.)

0.4% 20,766

Revolving Credit-i

4

0.4% 21,004

250,000,000 Redeemable Cumulative Vendor Financing Scheme-i

and Convertible Preference Share (RCCPS) 1.0% 48,219

owned by MOF (Inc.) Contract Financing Overseas-i

1.4% 69,986

Overseas Investment Financing-i

MOF (Inc.), as the shareholder of the special right redeemable

preference share, has the right to appoint no more than four Islamic

(4) members out of the maximum 12 members to the Bank’s

Board of Directors (the Board), including the appointment of the 49%

Chairman. Any appointment to the Board and the appointment

of the Chief Executive Officer of the Bank is subject to the RM2,406,784

approval by MOF (Inc.). The Bank’s Board currently comprises

the Chairman (who is also an independent non-executive 7.6% 374,317

director), three other independent non-executive directors, Overseas Project Financing-i

and two non-independent non-executive directors, one 10.5% 516,403

being a representative from MOF (Inc.) and the other being Supplier Financing-i

a representative from Ministry of Investment, Trade and 27.4% 1,354,748

Industry (MITI). Term Financing-i

On 1 May 2025, the Bank became a subsidiary of Bank

Pembangunan Malaysia Berhad (BPMB) which is wholly owned

by MOF (Inc.).