Page 9 - Exim iar24_Ebook

P. 9

EXIM BANK MALAYSIA ANNUAL REPORT 2024

1 A VISION TO SERVE 7

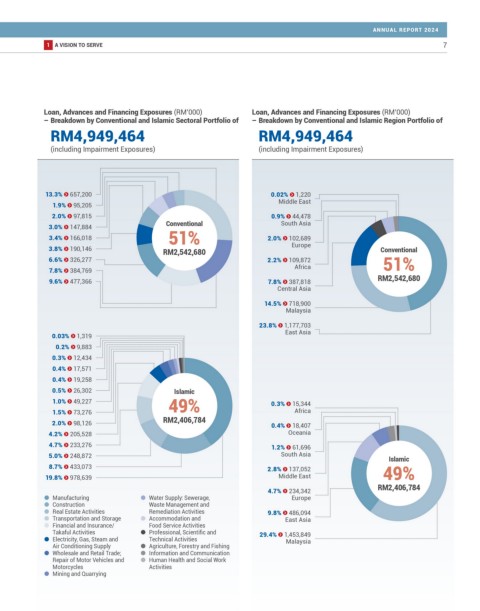

Loan, Advances and Financing Exposures (RM’000) Loan, Advances and Financing Exposures (RM’000)

– Breakdown by Conventional and Islamic Sectoral Portfolio of – Breakdown by Conventional and Islamic Region Portfolio of

RM4,949,464 RM4,949,464

(including Impairment Exposures) (including Impairment Exposures)

13.3% 657,200 0.02% 1,220

Middle East

1.9% 95,205

2.0% 97,815 0.9% 44,478

3.0% 147,884 Conventional South Asia

3.4% 166,018 51% 2.0% 102,689

3.8% 190,146 RM2,542,680 Europe Conventional

6.6% 326,277 2.2% 109,872 51%

Africa

7.8% 384,769

9.6% 477,366 7.8% 387,818 RM2,542,680

Central Asia

14.5% 718,900

Malaysia

23.8% 1,177,703

0.03% 1,319 East Asia

0.2% 9,883

0.3% 12,434

0.4% 17,571

0.4% 19,258

0.5% 26,302 Islamic

1.0% 49,227 49% 0.3% 15,344

1.5% 73,276 Africa

2.0% 98,126 RM2,406,784 0.4% 18,407

4.2% 205,528 Oceania

4.7% 233,276 1.2% 61,696

5.0% 248,872 South Asia Islamic

8.7% 433,073 2.8% 137,052 49%

19.8% 978,639 Middle East

RM2,406,784

4.7% 234,342

Manufacturing Water Supply: Sewerage, Europe

Construction Waste Management and

Real Estate Activities Remediation Activities 9.8% 486,094

Transportation and Storage Accommodation and East Asia

Financial and Insurance/ Food Service Activities

Takaful Activities Professional, Scientific and 29.4% 1,453,849

Electricity, Gas, Steam and Technical Activities Malaysia

Air Conditioning Supply Agriculture, Forestry and Fishing

Wholesale and Retail Trade; Information and Communication

Repair of Motor Vehicles and Human Health and Social Work

Motorcycles Activities

Mining and Quarrying