Page 102 - EXIM_AR2021

P. 102

100 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

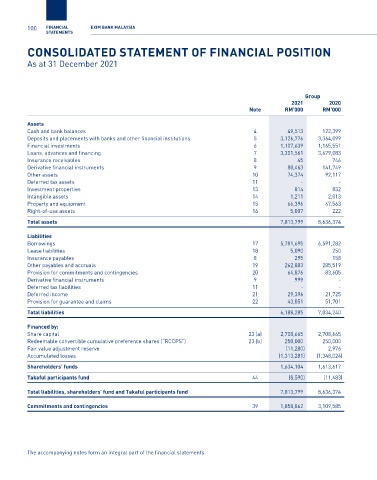

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2021

Group

2021 2020

Note RM’000 RM’000

Assets

Cash and bank balances 4 49,513 122,399

Deposits and placements with banks and other financial institutions 5 3,126,776 3,364,099

Financial investments 6 1,107,639 1,165,551

Loans, advances and financing 7 3,301,561 3,679,083

Insurance receivables 8 45 746

Derivative financial instruments 9 80,463 141,749

Other assets 10 74,374 92,117

Deferred tax assets 11 - -

Investment properties 13 814 832

Intangible assets 14 1,211 2,013

Property and equipment 15 66,396 67,563

Right-of-use assets 16 5,007 222

Total assets 7,813,799 8,636,374

Liabilities

Borrowings 17 5,781,695 6,591,282

Lease liabilities 18 5,090 250

Insurance payables 8 295 158

Other payables and accruals 19 262,883 285,519

Provision for commitments and contingencies 20 64,876 83,605

Derivative financial instruments 9 999 -

Deferred tax liabilities 11 - -

Deferred income 21 29,396 21,725

Provision for guarantee and claims 22 43,051 51,701

Total liabilities 6,188,285 7,034,240

Financed by:

Share capital 23 (a) 2,708,665 2,708,665

Redeemable convertible cumulative preference shares (“RCCPS”) 23 (b) 250,000 250,000

Fair value adjustment reserve (11,280) 2,976

Accumulated losses (1,313,281) (1,348,024)

Shareholders’ funds 1,634,104 1,613,617

Takaful participants fund 44 (8,590) (11,483)

Total liabilities, shareholders’ fund and Takaful participants fund 7,813,799 8,636,374

Commitments and contingencies 39 1,858,862 3,109,585

The accompanying notes form an integral part of the financial statements.