Page 129 - EXIM_AR2021

P. 129

ANNUAL REPORT 2021 127

Notes to the fiNaNcial statemeNts

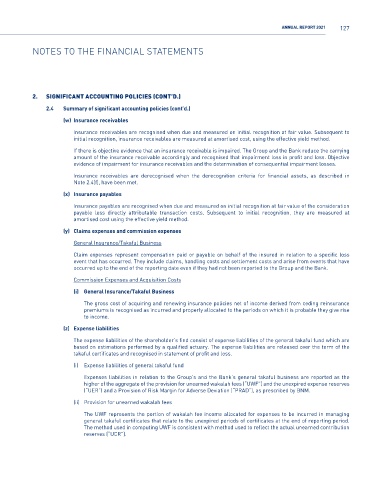

2. significant accOUnting POlicies (cOnt’D.)

2.4 Summary of significant accounting policies (cont’d.)

(w) Insurance receivables

Insurance receivables are recognised when due and measured on initial recognition at fair value. Subsequent to

initial recognition, insurance receivables are measured at amortised cost, using the effective yield method.

If there is objective evidence that an insurance receivable is impaired. The Group and the Bank reduce the carrying

amount of the insurance receivable accordingly and recognised that impairment loss in profit and loss. Objective

evidence of impairment for insurance receivables and the determination of consequential impairment losses.

Insurance receivables are derecognised when the derecognition criteria for financial assets, as described in

Note 2.4(f), have been met.

(x) Insurance payables

Insurance payables are recognised when due and measured on initial recognition at fair value of the consideration

payable less directly attributable transaction costs. Subsequent to initial recognition, they are measured at

amortised cost using the effective yield method.

(y) Claims expenses and commission expenses

General Insurance/Takaful Business

Claim expenses represent compensation paid or payable on behalf of the insured in relation to a specific loss

event that has occurred. They include claims, handling costs and settlement costs and arise from events that have

occurred up to the end of the reporting date even if they had not been reported to the Group and the Bank.

Commission Expenses and Acquisition Costs

(i) General Insurance/Takaful Business

The gross cost of acquiring and renewing insurance policies net of income derived from ceding reinsurance

premiums is recognised as incurred and properly allocated to the periods on which it is probable they give rise

to income.

(z) Expense liabilities

The expense liabilities of the shareholder’s find consist of expense liabilities of the general takaful fund which are

based on estimations performed by a qualified actuary. The expense liabilities are released over the term of the

takaful certificates and recognised in statement of profit and loss.

(i) Expense liabilities of general takaful fund

Expenses liabilities in relation to the Group’s and the Bank’s general takaful business are reported as the

higher of the aggregate of the provision for unearned wakalah fees (“UWF”) and the unexpired expense reserves

(“UER”) and a Provision of Risk Margin for Adverse Deviation (“PRAD”), as prescribed by BNM.

(ii) Provision for unearned wakalah fees

The UWF represents the portion of wakalah fee income allocated for expenses to be incurred in managing

general takaful certificates that relate to the unexpired periods of certificates at the end of reporting period.

The method used in computing UWF is consistent with method used to reflect the actual unearned contribution

reserves (“UCR”).