Page 209 - EXIM_AR2021

P. 209

ANNUAL REPORT 2021 207

Notes to the fiNaNcial statemeNts

43. insUrance risks

The principal underwriting risk to which the Group and the Bank is exposed is credit risk in connection with credit, guarantee

and political risk insurance underwriting activities. Management has established underwriting processes and limits to manage

this risk by performing credit review on its policy holders and buyers.

The underwriting function undertakes qualitative and quantitative risk assessments on all buyers and clients before deciding

on an approved insured amount. Policies in riskier markets may be rejected or charged at a higher premium rate accompanied

by stringent terms and conditions to commensurate the risks.

Concentration limits are set to avoid heavy concentration within a specific region or country. Maximum limits are set for buyer

credit limits and client facility limits for prudent risk mitigation.

For the monitoring of buyer risks, the Group and the Bank takes into consideration both qualitative and quantitative factors and

conducts regular reviews on the buyers’ credit standing and payment performance to track any deterioration in their financial

position that may result in a loss to the Group and the Bank.

On country risk, the Group and the Bank periodically reviews the economic and political conditions of the insured markets as

to revise its guidelines, wherever appropriate. In order to mitigate the insurance risk, the Group and the Bank may cede or

transfer the risk to another insurance company. The ceding arrangement minimises the net loss to the Group and the Bank

arising from potential claims.

Key assumptions

The sensitivity analysis is based upon the assumptions set out in the actuarial report and is subject to the reliances and

limitations contained within the report. One particular reliance is that the net sensitivity results assume that all reinsurance

recoveries are receivable in full.

The sensitivity items shown are independent of each other. In practice, a combination of adverse and favourable changes could

occur.

The sensitivity results are not intended to capture all possible outcomes. Significantly more adverse or favourable results are

possible.

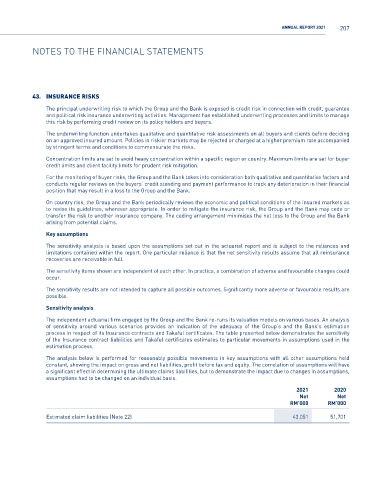

Sensitivity analysis

The independent actuarial firm engaged by the Group and the Bank re-runs its valuation models on various bases. An analysis

of sensitivity around various scenarios provides an indication of the adequacy of the Group’s and the Bank’s estimation

process in respect of its Insurance contracts and Takaful certificates. The table presented below demonstrates the sensitivity

of the Insurance contract liabilities and Takaful certificates estimates to particular movements in assumptions used in the

estimation process.

The analysis below is performed for reasonably possible movements in key assumptions with all other assumptions held

constant, showing the impact on gross and net liabilities, profit before tax and equity. The correlation of assumptions will have

a significant effect in determining the ultimate claims liabilities, but to demonstrate the impact due to changes in assumptions,

assumptions had to be changed on an individual basis.

2021 2020

Net Net

RM’000 RM’000

Estimated claim liabilities (Note 22) 43,051 51,701