Page 205 - EXIM_AR2021

P. 205

ANNUAL REPORT 2021 203

Notes to the fiNaNcial statemeNts

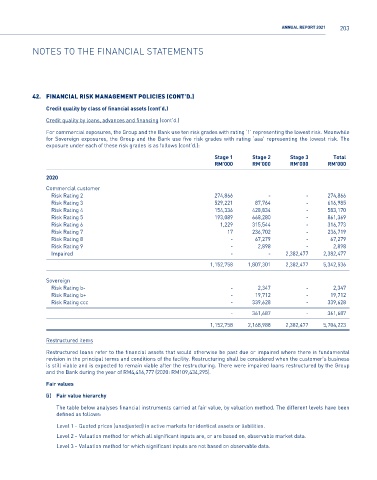

42. financial risk management POlicies (cOnt’D.)

Credit quality by class of financial assets (cont’d.)

Credit quality by loans, advances and financing (cont’d.)

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk. The

exposure under each of these risk grades is as follows (cont’d.):

Stage 1 Stage 2 Stage 3 Total

RM’000 RM’000 RM’000 RM’000

2020

Commercial customer

Risk Rating 2 274,866 - - 274,866

Risk Rating 3 529,221 87,764 - 616,985

Risk Rating 4 154,336 428,834 - 583,170

Risk Rating 5 193,089 668,280 - 861,369

Risk Rating 6 1,229 315,544 - 316,773

Risk Rating 7 17 236,702 - 236,719

Risk Rating 8 - 67,279 - 67,279

Risk Rating 9 - 2,898 - 2,898

Impaired - - 2,382,477 2,382,477

1,152,758 1,807,301 2,382,477 5,342,536

Sovereign

Risk Rating b- - 2,347 - 2,347

Risk Rating b+ - 19,712 - 19,712

Risk Rating ccc - 339,628 - 339,628

- 361,687 - 361,687

1,152,758 2,168,988 2,382,477 5,704,223

Restructured items

Restructured loans refer to the financial assets that would otherwise be past due or impaired where there is fundamental

revision in the principal terms and conditions of the facility. Restructuring shall be considered when the customer’s business

is still viable and is expected to remain viable after the restructuring. There were impaired loans restructured by the Group

and the Bank during the year of RM4,416,777 (2020: RM109,434,295).

Fair values

(i) Fair value hierarchy

The table below analyses financial instruments carried at fair value, by valuation method. The different levels have been

defined as follows:

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 - Valuation method for which all significant inputs are, or are based on, observable market data.

Level 3 - Valuation method for which significant inputs are not based on observable data.