Page 204 - EXIM_AR2021

P. 204

202 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

Notes to the fiNaNcial statemeNts

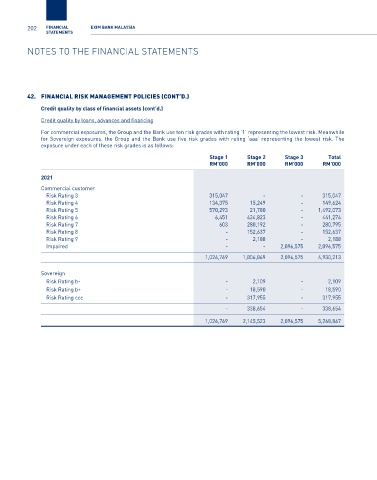

42. financial risk management POlicies (cOnt’D.)

Credit quality by class of financial assets (cont’d.)

Credit quality by loans, advances and financing

For commercial exposures, the Group and the Bank use ten risk grades with rating ‘1’ representing the lowest risk. Meanwhile

for Sovereign exposures, the Group and the Bank use five risk grades with rating ‘aaa’ representing the lowest risk. The

exposure under each of these risk grades is as follows:

Stage 1 Stage 2 Stage 3 Total

RM’000 RM’000 RM’000 RM’000

2021

Commercial customer

Risk Rating 3 315,047 - - 315,047

Risk Rating 4 134,375 15,249 - 149,624

Risk Rating 5 570,293 21,780 - 1,492,073

Risk Rating 6 6,451 434,823 - 441,274

Risk Rating 7 603 280,192 - 280,795

Risk Rating 8 - 152,637 - 152,637

Risk Rating 9 - 2,188 - 2,188

Impaired - - 2,096,575 2,096,575

1,026,769 1,806,869 2,096,575 4,930,213

Sovereign

Risk Rating b- - 2,109 - 2,109

Risk Rating b+ - 18,590 - 18,590

Risk Rating ccc - 317,955 - 317,955

- 338,654 - 338,654

1,026,769 2,145,523 2,096,575 5,268,867