Page 90 - EXIM_AR2021

P. 90

88 FINANCIAL EXIM BANK MALAYSIA

STATEMENTS

DIRECTORS’ REPORT

significant anD sUbseqUent events

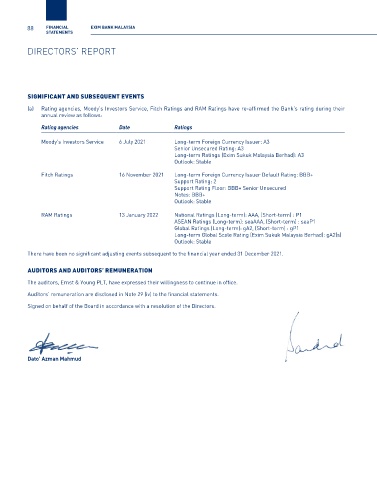

(a) Rating agencies, Moody’s Investors Service, Fitch Ratings and RAM Ratings have re-affirmed the Bank’s rating during their

annual review as follows:

Rating agencies Date Ratings

Moody’s Investors Service 6 July 2021 Long-term Foreign Currency Issuer: A3

Senior Unsecured Rating: A3

Long-term Ratings (Exim Sukuk Malaysia Berhad): A3

Outlook: Stable

Fitch Ratings 16 November 2021 Long-term Foreign Currency Issuer Default Rating: BBB+

Support Rating: 2

Support Rating Floor: BBB+ Senior Unsecured

Notes: BBB+

Outlook: Stable

RAM Ratings 13 January 2022 National Ratings (Long-term): AAA, (Short-term) : P1

ASEAN Ratings (Long-term): seaAAA, (Short-term) : seaP1

Global Ratings (Long-term): gA2, (Short-term) : gP1

Long-term Global Scale Rating (Exim Sukuk Malaysia Berhad): gA2(s)

Outlook: Stable

There have been no significant adjusting events subsequent to the financial year ended 31 December 2021.

aUDitOrs anD aUDitOrs’ remUneratiOn

The auditors, Ernst & Young PLT, have expressed their willingness to continue in office.

Auditors’ remuneration are disclosed in Note 29 (iv) to the financial statements.

Signed on behalf of the Board in accordance with a resolution of the Directors.

Dato’ Azman Mahmud Dato’ Wong Lee Yun