Page 107 - EXIM-Bank_Annual-Report-2022

P. 107

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 105

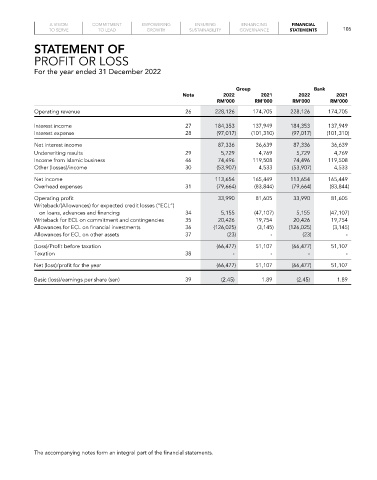

STATEmENT OF

PROFIT OR LOSS

For the year ended 31 December 2022

Group Bank

Note 2022 2021 2022 2021

rM’000 rM’000 rM’000 rM’000

Operating revenue 26 228,126 174,705 228,126 174,705

Interest income 27 184,353 137,949 184,353 137,949

Interest expense 28 (97,017) (101,310) (97,017) (101,310)

Net interest income 87,336 36,639 87,336 36,639

Underwriting results 29 5,729 4,769 5,729 4,769

Income from Islamic business 46 74,496 119,508 74,496 119,508

Other (losses)/income 30 (53,907) 4,533 (53,907) 4,533

Net income 113,654 165,449 113,654 165,449

Overhead expenses 31 (79,664) (83,844) (79,664) (83,844)

Operating profit 33,990 81,605 33,990 81,605

Writeback/(Allowances) for expected credit losses (“ECL”)

on loans, advances and financing 34 5,155 (47,107) 5,155 (47,107)

Writeback for ECL on commitment and contingencies 35 20,426 19,754 20,426 19,754

Allowances for ECL on financial investments 36 (126,025) (3,145) (126,025) (3,145)

Allowances for ECL on other assets 37 (23) - (23) -

(Loss)/Profit before taxation (66,477) 51,107 (66,477) 51,107

Taxation 38 - - - -

Net (loss)/profit for the year (66,477) 51,107 (66,477) 51,107

Basic (loss)/earnings per share (sen) 39 (2.45) 1.89 (2.45) 1.89

The accompanying notes form an integral part of the financial statements.