Page 159 - EXIM-Bank_Annual-Report-2022

P. 159

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 157

Notes to the fiNaNcial statemeNts

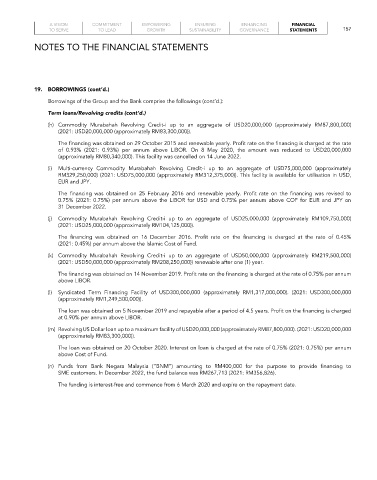

19. BorroWINGs (cont’d.)

Borrowings of the Group and the Bank comprise the followings (cont’d.):

Term loans/Revolving credits (cont’d.)

(h) Commodity Murabahah Revolving Credit-i up to an aggregate of USD20,000,000 (approximately RM87,800,000)

(2021: USD20,000,000 (approximately RM83,300,000)).

The financing was obtained on 29 October 2015 and renewable yearly. Profit rate on the financing is charged at the rate

of 0.93% (2021: 0.93%) per annum above LIBOR. On 8 May 2020, the amount was reduced to USD20,000,000

(approximately RM80,340,000). This facility was cancelled on 14 June 2022.

(i) Multi-currency Commodity Murabahah Revolving Credit-i up to an aggregate of USD75,000,000 (approximately

RM329,250,000) (2021: USD75,000,000 (approximately RM312,375,000)). This facility is available for utilisation in USD,

EUR and JPY.

The financing was obtained on 25 February 2016 and renewable yearly. Profit rate on the financing was revised to

0.75% (2021: 0.75%) per annum above the LIBOR for USD and 0.75% per annum above COF for EUR and JPY on

31 December 2022.

(j) Commodity Murabahah Revolving Credit-i up to an aggregate of USD25,000,000 (approximately RM109,750,000)

(2021: USD25,000,000 (approximately RM104,125,000)).

The financing was obtained on 16 December 2016. Profit rate on the financing is charged at the rate of 0.45%

(2021: 0.45%) per annum above the Islamic Cost of Fund.

(k) Commodity Murabahah Revolving Credit-i up to an aggregate of USD50,000,000 (approximately RM219,500,000)

(2021: USD50,000,000 (approximately RM208,250,000)) renewable after one (1) year.

The financing was obtained on 14 November 2019. Profit rate on the financing is charged at the rate of 0.75% per annum

above LIBOR.

(l) Syndicated Term Financing Facility of USD300,000,000 (approximately RM1,317,000,000). (2021: USD300,000,000

(approximately RM1,249,500,000)).

The loan was obtained on 5 November 2019 and repayable after a period of 4.5 years. Profit on the financing is charged

at 0.90% per annum above LIBOR.

(m) Revolving US Dollar loan up to a maximum facility of USD20,000,000 (approximately RM87,800,000). (2021: USD20,000,000

(approximately RM83,300,000)).

The loan was obtained on 20 October 2020. Interest on loan is charged at the rate of 0.75% (2021: 0.75%) per annum

above Cost of Fund.

(n) Funds from Bank Negara Malaysia (“BNM”) amounting to RM400,000 for the purpose to provide financing to

SME customers. In December 2022, the fund balance was RM267,713 (2021: RM356,826).

The funding is interest-free and commence from 6 March 2020 and expire on the repayment date.