Page 162 - EXIM-Bank_Annual-Report-2022

P. 162

160 eXIM BANK MALAYsIA ANNUAL REPORT 2022

Notes to the fiNaNcial statemeNts

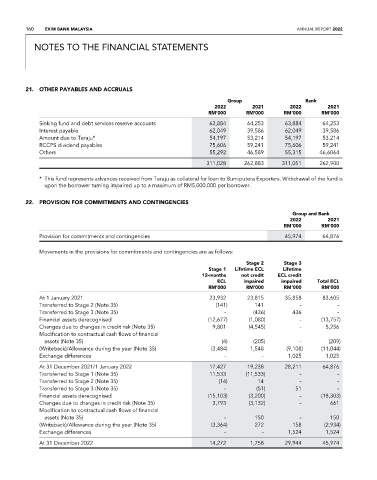

21. other PAYABLes AND ACCruALs

Group Bank

2022 2021 2022 2021

rM’000 rM’000 rM’000 rM’000

Sinking fund and debt services reserve accounts 63,884 64,253 63,884 64,253

Interest payable 62,049 39,586 62,049 39,586

Amount due to Teraju* 54,197 53,214 54,197 53,214

RCCPS dividend payables 75,606 59,241 75,606 59,241

Others 55,292 46,589 55,315 46,6064

311,028 262,883 311,051 262,900

* This fund represents advances received from Teraju as collateral for loan to Bumiputera Exporters. Withdrawal of the fund is

upon the borrower turning impaired up to a maximum of RM5,000,000 per borrower.

22. ProvIsIoN For CoMMItMeNts AND CoNtINGeNCIes

Group and Bank

2022 2021

rM’000 rM’000

Provision for commitments and contingencies 45,974 64,876

Movements in the provisions for commitments and contingencies are as follows:

stage 2 stage 3

stage 1 Lifetime eCL Lifetime

12-months not credit eCL credit

eCL impaired impaired total eCL

rM’000 rM’000 rM’000 rM’000

At 1 January 2021 23,932 23,815 35,858 83,605

Transferred to Stage 2 (Note 35) (141) 141 - -

Transferred to Stage 3 (Note 35) - (436) 436 -

Financial assets derecognised (12,677) (1,080) - (13,757)

Changes due to changes in credit risk (Note 35) 9,801 (4,545) - 5,256

Modification to contractual cash flows of financial

assets (Note 35) (4) (205) - (209)

(Writeback)/Allowance during the year (Note 35) (3,484) 1,548 (9,108) (11,044)

Exchange differences - - 1,025 1,025

At 31 December 2021/1 January 2022 17,427 19,238 28,211 64,876

Transferred to Stage 1 (Note 35) 11,533 (11,533) - -

Transferred to Stage 2 (Note 35) (14) 14 - -

Transferred to Stage 3 (Note 35) - (51) 51 -

Financial assets derecognised (15,103) (3,200) - (18,303)

Changes due to changes in credit risk (Note 35) 3,793 (3,132) - 661

Modification to contractual cash flows of financial

assets (Note 35) - 150 - 150

(Writeback)/Allowance during the year (Note 35) (3,364) 272 158 (2,934)

Exchange differences - - 1,524 1,524

At 31 December 2022 14,272 1,758 29,944 45,974