Page 167 - EXIM-Bank_Annual-Report-2022

P. 167

A VISION COMMITMENT EMPOWERING ENSURING ENHANCING FINANCIAL

TO SERVE TO LEAD GROWTH SUSTAINABILITY GOVERNANCE STATEMENTS 165

Notes to the fiNaNcial statemeNts

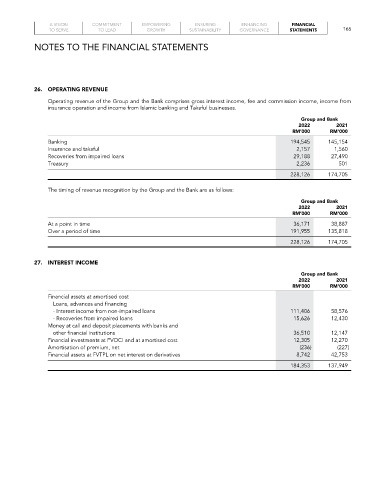

26. oPerAtING reveNue

Operating revenue of the Group and the Bank comprises gross interest income, fee and commission income, income from

insurance operation and income from Islamic banking and Takaful businesses.

Group and Bank

2022 2021

rM’000 rM’000

Banking 194,545 145,154

Insurance and takaful 2,157 1,560

Recoveries from impaired loans 29,188 27,490

Treasury 2,236 501

228,126 174,705

The timing of revenue recognition by the Group and the Bank are as follows:

Group and Bank

2022 2021

rM’000 rM’000

At a point in time 36,171 38,887

Over a period of time 191,955 135,818

228,126 174,705

27. INterest INCoMe

Group and Bank

2022 2021

rM’000 rM’000

Financial assets at amortised cost

Loans, advances and financing

- Interest income from non-impaired loans 111,406 58,576

- Recoveries from impaired loans 15,626 12,430

Money at call and deposit placements with banks and

other financial institutions 36,510 12,147

Financial investments at FVOCI and at amortised cost 12,305 12,270

Amortisation of premium, net (236) (227)

Financial assets at FVTPL on net interest on derivatives 8,742 42,753

184,353 137,949