Page 157 - EXIM-Bank_Annual-Report-2023

P. 157

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 155

Notes to the fiNaNcial statemeNts

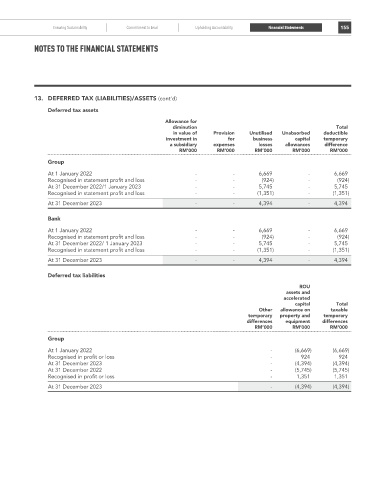

13. DEFERRED TAX (LIABILITIES)/ASSETS (cont’d)

Deferred tax assets

Allowance for

diminution Total

in value of Provision unutilised unabsorbed deductible

investment in for business capital temporary

a subsidiary expenses losses allowances difference

rM’000 rM’000 rM’000 rM’000 rM’000

Group

At 1 January 2022 - - 6,669 - 6,669

Recognised in statement profit and loss - - (924) - (924)

At 31 December 2022/1 January 2023 - - 5,745 - 5,745

Recognised in statement profit and loss - - (1,351) - (1,351)

At 31 December 2023 - - 4,394 - 4,394

Bank

At 1 January 2022 - - 6,669 - 6,669

Recognised in statement profit and loss - - (924) - (924)

At 31 December 2022/ 1 January 2023 - - 5,745 - 5,745

Recognised in statement profit and loss - - (1,351) - (1,351)

At 31 December 2023 - - 4,394 - 4,394

Deferred tax liabilities

rou

assets and

accelerated

capital Total

Other allowance on taxable

temporary property and temporary

differences equipment differences

rM’000 rM’000 rM’000

Group

At 1 January 2022 - (6,669) (6,669)

Recognised in profit or loss - 924 924

At 31 December 2023 - (4,394) (4,394)

At 31 December 2022 - (5,745) (5,745)

Recognised in profit or loss - 1,351 1,351

At 31 December 2023 - (4,394) (4,394)