Page 152 - EXIM-Bank_Annual-Report-2023

P. 152

EXIM BANk MALAySIA

150 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

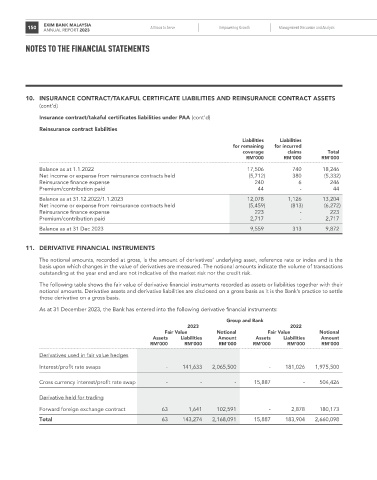

10. INSuRANCE CONTRACT/TAkAFuL CERTIFICATE LIABILITIES AND REINSuRANCE CONTRACT ASSETS

(cont’d)

Insurance contract/takaful certificates liabilities under PAA (cont’d)

Reinsurance contract liabilities

Liabilities Liabilities

for remaining for incurred

coverage claims Total

rM’000 rM’000 rM’000

Balance as at 1.1.2022 17,506 740 18,246

Net income or expense from reinsurance contracts held (5,712) 380 (5,332)

Reinsurance finance expense 240 6 246

Premium/contribution paid 44 - 44

Balance as at 31.12.2022/1.1.2023 12,078 1,126 13,204

Net income or expense from reinsurance contracts held (5,459) (813) (6,272)

Reinsurance finance expense 223 - 223

Premium/contribution paid 2,717 - 2,717

Balance as at 31 Dec 2023 9,559 313 9,872

11. DErIvATIvE FINANCIAL INSTruMENTS

The notional amounts, recorded at gross, is the amount of derivatives’ underlying asset, reference rate or index and is the

basis upon which changes in the value of derivatives are measured. The notional amounts indicate the volume of transactions

outstanding at the year end and are not indicative of the market risk nor the credit risk.

The following table shows the fair value of derivative financial instruments recorded as assets or liabilities together with their

notional amounts. Derivative assets and derivative liabilities are disclosed on a gross basis as it is the Bank’s practice to settle

those derivative on a gross basis.

As at 31 December 2023, the Bank has entered into the following derivative financial instruments:

Group and Bank

2023 2022

Fair Value Notional Fair Value Notional

Assets Liabilities Amount Assets Liabilities Amount

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Derivatives used in fair value hedges

Interest/profit rate swaps - 141,633 2,065,500 - 181,026 1,975,500

Cross currency interest/profit rate swap - - - 15,887 - 504,426

Derivative held for trading

Forward foreign exchange contract 63 1,641 102,591 - 2,878 180,173

Total 63 143,274 2,168,091 15,887 183,904 2,660,098