Page 149 - EXIM-Bank_Annual-Report-2023

P. 149

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 147

Notes to the fiNaNcial statemeNts

9. LoANS, ADvANCES AND FINANCING (cont’d)

(x) Overlays and adjustments for ECL amid COVID-19 environment and current emerging risks

As the current MFRS 9 models are not expected to generate levels of ECL with sufficient reliability in view of the current

emerging risks, overlays and post-model adjustments have been applied to determine a sufficient overall level of ECLs for

the year ended and as at 31 December 2023.

The overlays involved significant level of judgement and reflect the management’s views of possible severities of the

pandemic and paths of recovery in the forward looking assessment for ECL estimation purposes.

The impact of the management overlays has been improved based on the latest performance by customers from

geopolitical tension, elevated inflation and increase in interest rates. The impact of these adjustments for financing

of the Group and the Bank as at 31 December 2023 amounted to RM690,630,000 (2022: RM783,183,000). Total

additional overlays for ECL maintained by the Group and the Bank as at 31 December 2023 stood at RM35,053,000

(2022: RM66,373,000).

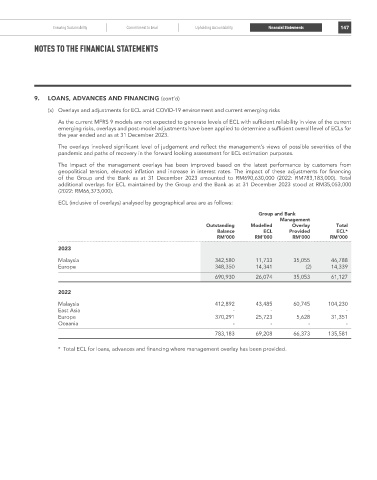

ECL (inclusive of overlays) analysed by geographical area are as follows:

Group and Bank

Management

Outstanding Modelled Overlay Total

Balance ECL Provided ECL*

rM’000 rM’000 rM’000 rM’000

2023

Malaysia 342,580 11,733 35,055 46,788

Europe 348,350 14,341 (2) 14,339

690,930 26,074 35,053 61,127

2022

Malaysia 412,892 43,485 60,745 104,230

East Asia - - - -

Europe 370,291 25,723 5,628 31,351

Oceania - - - -

783,183 69,208 66,373 135,581

* Total ECL for loans, advances and financing where management overlay has been provided.