Page 144 - EXIM-Bank_Annual-Report-2023

P. 144

EXIM BANk MALAySIA

142 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

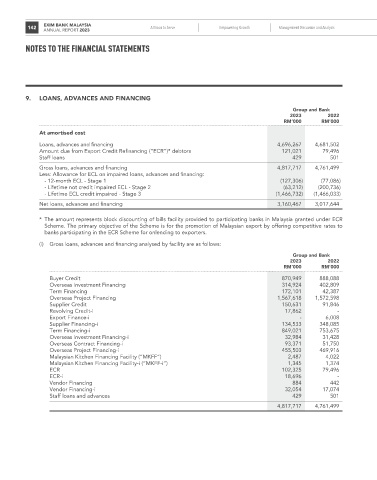

9. LoANS, ADvANCES AND FINANCING

Group and Bank

2023 2022

rM’000 rM’000

At amortised cost

Loans, advances and financing 4,696,267 4,681,502

Amount due from Export Credit Refinancing (“ECR”)* debtors 121,021 79,496

Staff loans 429 501

Gross loans, advances and financing 4,817,717 4,761,499

Less: Allowance for ECL on impaired loans, advances and financing:

- 12-month ECL - Stage 1 (127,306) (77,086)

- Lifetime not credit impaired ECL - Stage 2 (63,212) (200,736)

- Lifetime ECL credit impaired - Stage 3 (1,466,732) (1,466,033)

Net loans, advances and financing 3,160,467 3,017,644

* The amount represents block discounting of bills facility provided to participating banks in Malaysia granted under ECR

Scheme. The primary objective of the Scheme is for the promotion of Malaysian export by offering competitive rates to

banks participating in the ECR Scheme for onlending to exporters.

(i) Gross loans, advances and financing analysed by facility are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Buyer Credit 870,949 888,088

Overseas Investment Financing 314,924 402,809

Term Financing 172,101 42,387

Overseas Project Financing 1,567,618 1,572,598

Supplier Credit 150,631 91,846

Revolving Credit-i 17,862 -

Export Finance-i - 6,008

Supplier Financing-i 134,533 348,085

Term Financing-i 849,021 753,675

Overseas Investment Financing-i 32,984 31,428

Overseas Contract Financing-i 93,371 51,750

Overseas Project Financing-i 455,503 469,916

Malaysian Kitchen Financing Facility (“MKFF”) 2,487 4,022

Malaysian Kitchen Financing Facility-i (“MKFF-i”) 1,345 1,374

ECR 102,325 79,496

ECR-i 18,696 -

Vendor Financing 884 442

Vendor Financing-i 32,054 17,074

Staff loans and advances 429 501

4,817,717 4,761,499