Page 142 - EXIM-Bank_Annual-Report-2023

P. 142

EXIM BANk MALAySIA

140 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

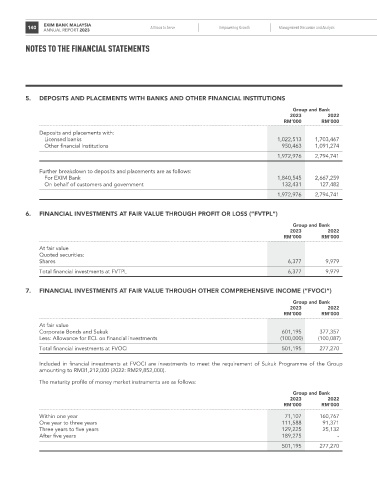

5. DEPoSITS AND PLACEMENTS WITh BANkS AND oThEr FINANCIAL INSTITuTIoNS

Group and Bank

2023 2022

rM’000 rM’000

Deposits and placements with:

Licensed banks 1,022,513 1,703,467

Other financial institutions 950,463 1,091,274

1,972,976 2,794,741

Further breakdown to deposits and placements are as follows:

For EXIM Bank 1,840,545 2,667,259

On behalf of customers and government 132,431 127,482

1,972,976 2,794,741

6. FINANCIAL INVESTMENTS AT FAIR VALuE THROuGH PROFIT OR LOSS (“FVTPL”)

Group and Bank

2023 2022

rM’000 rM’000

At fair value

Quoted securities:

Shares 6,377 9,979

Total financial investments at FVTPL 6,377 9,979

7. FINANCIAL INVESTMENTS AT FAIR VALuE THROuGH OTHER COMPREHENSIVE INCOME (“FVOCI”)

Group and Bank

2023 2022

rM’000 rM’000

At fair value

Corporate Bonds and Sukuk 601,195 377,357

Less: Allowance for ECL on financial investments (100,000) (100,087)

Total financial investments at FVOCI 501,195 277,270

Included in financial investments at FVOCI are investments to meet the requirement of Sukuk Programme of the Group

amounting to RM31,212,000 (2022: RM29,852,000).

The maturity profile of money market instruments are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Within one year 71,107 160,767

One year to three years 111,588 91,371

Three years to five years 129,225 25,132

After five years 189,275 -

501,195 277,270