Page 147 - EXIM-Bank_Annual-Report-2023

P. 147

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 145

Notes to the fiNaNcial statemeNts

9. LoANS, ADvANCES AND FINANCING (cont’d)

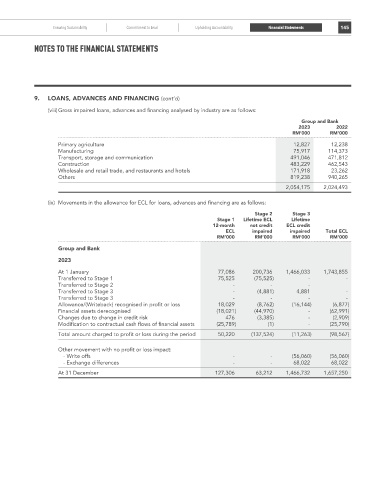

(viii) Gross impaired loans, advances and financing analysed by industry are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Primary agriculture 12,827 12,238

Manufacturing 75,917 114,373

Transport, storage and communication 491,046 471,812

Construction 483,229 462,543

Wholesale and retail trade, and restaurants and hotels 171,918 23,262

Others 819,238 940,265

2,054,175 2,024,493

(ix) Movements in the allowance for ECL for loans, advances and financing are as follows:

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

rM’000 rM’000 rM’000 rM’000

Group and Bank

2023

At 1 January 77,086 200,736 1,466,033 1,743,855

Transferred to Stage 1 75,525 (75,525) - -

Transferred to Stage 2 - - -

Transferred to Stage 3 - (4,881) 4,881 -

Transferred to Stage 3 - - - -

Allowance/(Writeback) recognised in profit or loss 18,029 (8,762) (16,144) (6,877)

Financial assets derecognised (18,021) (44,970) - (62,991)

Changes due to change in credit risk 476 (3,385) - (2,909)

Modification to contractual cash flows of financial assets (25,789) (1) - (25,790)

Total amount charged to profit or loss during the period 50,220 (137,524) (11,263) (98,567)

Other movement with no profit or loss impact:

- Write offs - - (56,060) (56,060)

- Exchange differences - - 68,022 68,022

At 31 December 127,306 63,212 1,466,732 1,657,250