Page 145 - EXIM-Bank_Annual-Report-2023

P. 145

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 143

Notes to the fiNaNcial statemeNts

9. LoANS, ADvANCES AND FINANCING (cont’d)

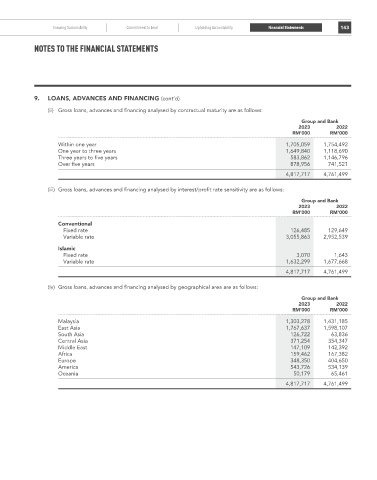

(ii) Gross loans, advances and financing analysed by contractual maturity are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Within one year 1,705,059 1,754,492

One year to three years 1,649,840 1,118,690

Three years to five years 583,862 1,146,796

Over five years 878,956 741,521

4,817,717 4,761,499

(iii) Gross loans, advances and financing analysed by interest/profit rate sensitivity are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Conventional

Fixed rate 126,485 129,649

Variable rate 3,055,863 2,952,539

Islamic

Fixed rate 3,070 1,643

Variable rate 1,632,299 1,677,668

4,817,717 4,761,499

(iv) Gross loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Malaysia 1,303,278 1,431,185

East Asia 1,767,637 1,598,107

South Asia 126,722 63,836

Central Asia 371,254 354,347

Middle East 147,109 142,392

Africa 159,462 167,382

Europe 348,350 404,650

America 543,726 534,139

Oceania 50,179 65,461

4,817,717 4,761,499