Page 148 - EXIM-Bank_Annual-Report-2023

P. 148

EXIM BANk MALAySIA

146 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

9. LoANS, ADvANCES AND FINANCING (cont’d)

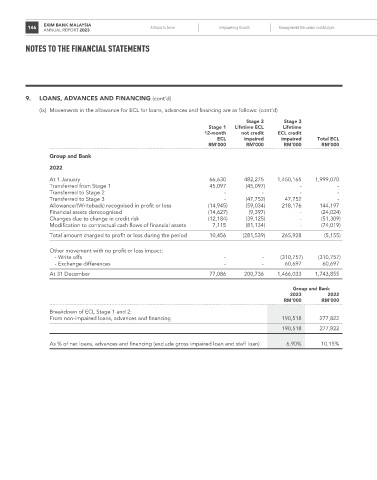

(ix) Movements in the allowance for ECL for loans, advances and financing are as follows: (cont’d)

Stage 2 Stage 3

Stage 1 Lifetime ECL Lifetime

12-month not credit ECL credit

ECL impaired impaired Total ECL

rM’000 rM’000 rM’000 rM’000

Group and Bank

2022

At 1 January 66,630 482,275 1,450,165 1,999,070

Transferred from Stage 1 45,097 (45,097) - -

Transferred to Stage 2 - - - -

Transferred to Stage 3 - (47,752) 47,752 -

Allowance/(Writeback) recognised in profit or loss (14,945) (59,034) 218,176 144,197

Financial assets derecognised (14,627) (9,397) - (24,024)

Changes due to change in credit risk (12,184) (39,125) - (51,309)

Modification to contractual cash flows of financial assets 7,115 (81,134) - (74,019)

Total amount charged to profit or loss during the period 10,456 (281,539) 265,928 (5,155)

Other movement with no profit or loss impact:

- Write offs - - (310,757) (310,757)

- Exchange differences - - 60,697 60,697

At 31 December 77,086 200,736 1,466,033 1,743,855

Group and Bank

2023 2022

rM’000 rM’000

Breakdown of ECL Stage 1 and 2:

From non-impaired loans, advances and financing 190,518 277,822

190,518 277,822

As % of net loans, advances and financing (exclude gross impaired loan and staff loan) 6.90% 10.15%