Page 146 - EXIM-Bank_Annual-Report-2023

P. 146

EXIM BANk MALAySIA

144 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

9. LoANS, ADvANCES AND FINANCING (cont’d)

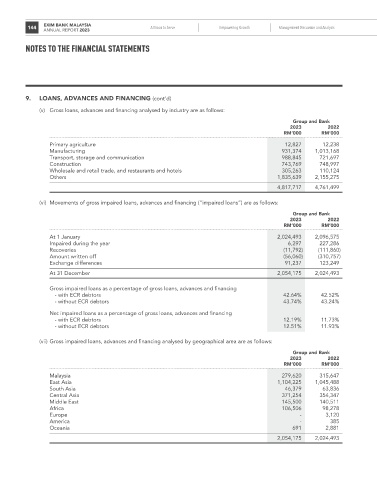

(v) Gross loans, advances and financing analysed by industry are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Primary agriculture 12,827 12,238

Manufacturing 931,374 1,013,168

Transport, storage and communication 988,845 721,697

Construction 743,769 748,997

Wholesale and retail trade, and restaurants and hotels 305,263 110,124

Others 1,835,639 2,155,275

4,817,717 4,761,499

(vi) Movements of gross impaired loans, advances and financing (“impaired loans”) are as follows:

Group and Bank

2023 2022

rM’000 rM’000

At 1 January 2,024,493 2,096,575

Impaired during the year 6,297 227,286

Recoveries (11,792) (111,860)

Amount written off (56,060) (310,757)

Exchange differences 91,237 123,249

At 31 December 2,054,175 2,024,493

Gross impaired loans as a percentage of gross loans, advances and financing

- with ECR debtors 42.64% 42.52%

- without ECR debtors 43.74% 43.24%

Net impaired loans as a percentage of gross loans, advances and financing

- with ECR debtors 12.19% 11.73%

- without ECR debtors 12.51% 11.93%

(vii) Gross impaired loans, advances and financing analysed by geographical area are as follows:

Group and Bank

2023 2022

rM’000 rM’000

Malaysia 279,620 315,647

East Asia 1,104,225 1,045,488

South Asia 46,379 63,836

Central Asia 371,254 354,347

Middle East 145,500 140,511

Africa 106,506 98,278

Europe - 3,120

America - 385

Oceania 691 2,881

2,054,175 2,024,493