Page 171 - EXIM-Bank_Annual-Report-2023

P. 171

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 169

Notes to the fiNaNcial statemeNts

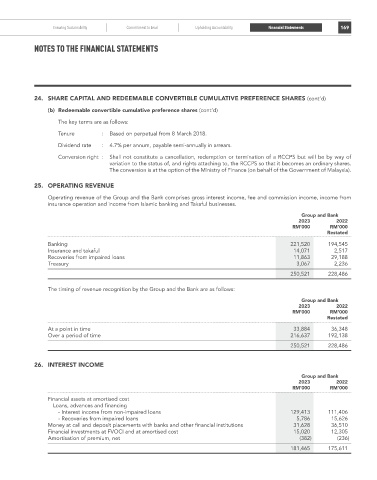

24. ShArE CAPITAL AND rEDEEMABLE CoNvErTIBLE CuMuLATIvE PrEFErENCE ShArES (cont’d)

(b) Redeemable convertible cumulative preference shares (cont’d)

The key terms are as follows:

Tenure : Based on perpetual from 8 March 2018.

Dividend rate : 4.7% per annum, payable semi-annually in arrears.

Conversion right : Shall not constitute a cancellation, redemption or termination of a RCCPS but will be by way of

variation to the status of, and rights attaching to, the RCCPS so that it becomes an ordinary shares.

The conversion is at the option of the Ministry of Finance (on behalf of the Government of Malaysia).

25. oPErATING rEvENuE

Operating revenue of the Group and the Bank comprises gross interest income, fee and commission income, income from

insurance operation and income from Islamic banking and Takaful businesses.

Group and Bank

2023 2022

rM’000 rM’000

restated

Banking 221,520 194,545

Insurance and takaful 14,071 2,517

Recoveries from impaired loans 11,863 29,188

Treasury 3,067 2,236

250,521 228,486

The timing of revenue recognition by the Group and the Bank are as follows:

Group and Bank

2023 2022

rM’000 rM’000

restated

At a point in time 33,884 36,348

Over a period of time 216,637 192,138

250,521 228,486

26. INTErEST INCoME

Group and Bank

2023 2022

rM’000 rM’000

Financial assets at amortised cost

Loans, advances and financing

- Interest income from non-impaired loans 129,413 111,406

- Recoveries from impaired loans 5,786 15,626

Money at call and deposit placements with banks and other financial institutions 31,628 36,510

Financial investments at FVOCI and at amortised cost 15,020 12,305

Amortisation of premium, net (382) (236)

181,465 175,611