Page 179 - EXIM-Bank_Annual-Report-2023

P. 179

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 177

Notes to the fiNaNcial statemeNts

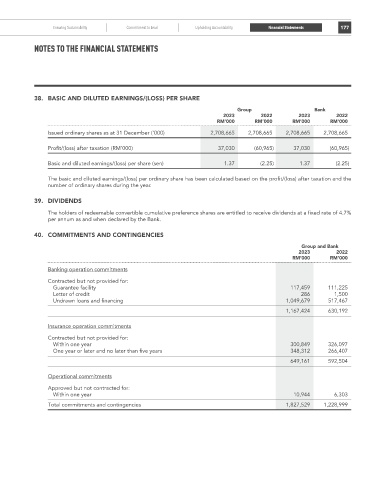

38. BASIC AND DILuTED EARNINGS/(LOSS) PER SHARE

Group Bank

2023 2022 2023 2022

rM’000 rM’000 rM’000 rM’000

Issued ordinary shares as at 31 December (‘000) 2,708,665 2,708,665 2,708,665 2,708,665

Profit/(loss) after taxation (RM’000) 37,030 (60,965) 37,030 (60,965)

Basic and diluted earnings/(loss) per share (sen) 1.37 (2.25) 1.37 (2.25)

The basic and diluted earnings/(loss) per ordinary share has been calculated based on the profit/(loss) after taxation and the

number of ordinary shares during the year.

39. DIvIDENDS

The holders of redeemable convertible cumulative preference shares are entitled to receive dividends at a fixed rate of 4.7%

per annum as and when declared by the Bank.

40. CoMMITMENTS AND CoNTINGENCIES

Group and Bank

2023 2022

rM’000 rM’000

Banking operation commitments

Contracted but not provided for:

Guarantee facility 117,459 111,225

Letter of credit 286 1,500

Undrawn loans and financing 1,049,679 517,467

1,167,424 630,192

Insurance operation commitments

Contracted but not provided for:

Within one year 300,849 326,097

One year or later and no later than five years 348,312 266,407

649,161 592,504

Operational commitments

Approved but not contracted for:

Within one year 10,944 6,303

Total commitments and contingencies 1,827,529 1,228,999