Page 178 - EXIM-Bank_Annual-Report-2023

P. 178

EXIM BANk MALAySIA

176 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

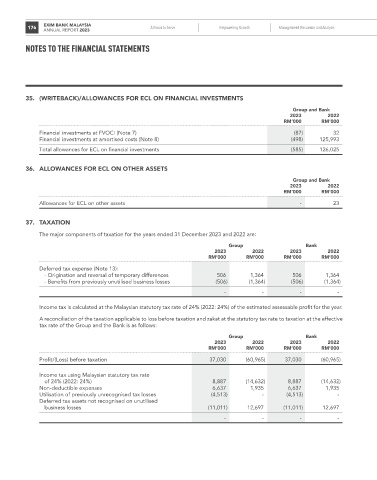

35. (WRITEBACk)/ALLOWANCES FOR ECL ON FINANCIAL INVESTMENTS

Group and Bank

2023 2022

rM’000 rM’000

Financial investments at FVOCI (Note 7) (87) 32

Financial investments at amortised costs (Note 8) (498) 125,993

Total allowances for ECL on financial investments (585) 126,025

36. ALLoWANCES For ECL oN oThEr ASSETS

Group and Bank

2023 2022

rM’000 rM’000

Allowances for ECL on other assets - 23

37. TAXATIoN

The major components of taxation for the years ended 31 December 2023 and 2022 are:

Group Bank

2023 2022 2023 2022

rM’000 rM’000 rM’000 rM’000

Deferred tax expense (Note 13):

- Origination and reversal of temporary differences 506 1,364 506 1,364

- Benefits from previously unutilised business losses (506) (1,364) (506) (1,364)

- - - -

Income tax is calculated at the Malaysian statutory tax rate of 24% (2022: 24%) of the estimated assessable profit for the year.

A reconciliation of the taxation applicable to loss before taxation and zakat at the statutory tax rate to taxation at the effective

tax rate of the Group and the Bank is as follows:

Group Bank

2023 2022 2023 2022

rM’000 rM’000 rM’000 rM’000

Profit/(Loss) before taxation 37,030 (60,965) 37,030 (60,965)

Income tax using Malaysian statutory tax rate

of 24% (2022: 24%) 8,887 (14,632) 8,887 (14,632)

Non-deductible expenses 6,637 1,935 6,637 1,935

Utilisation of previously unrecognised tax losses (4,513) - (4,513) -

Deferred tax assets not recognised on unutilised

business losses (11,011) 12,697 (11,011) 12,697

- - - -