Page 247 - EXIM-Bank_Annual-Report-2023

P. 247

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 245

Notes to the fiNaNcial statemeNts

45. ISLAMIC BuSINESS FuNDS (cont’d)

Notes to the financial statements for Islamic business fund and Takaful fund for the financial year ended 31 December 2023

(cont’d)

(r) Liquidity risk management (cont’d)

Measurement (cont’d)

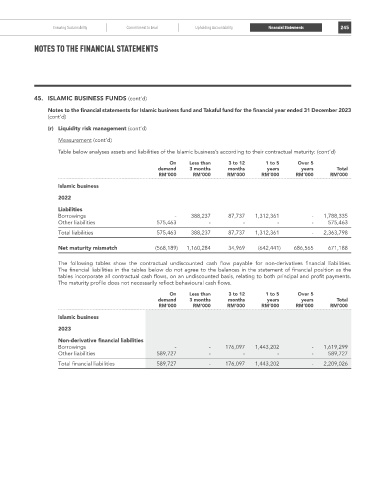

Table below analyses assets and liabilities of the Islamic business’s according to their contractual maturity: (cont’d)

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Islamic business

2022

Liabilities

Borrowings - 388,237 87,737 1,312,361 - 1,788,335

Other liabilities 575,463 - - - - 575,463

Total liabilities 575,463 388,237 87,737 1,312,361 - 2,363,798

Net maturity mismatch (568,189) 1,160,284 34,969 (642,441) 686,565 671,188

The following tables show the contractual undiscounted cash flow payable for non-derivatives financial liabilities.

The financial liabilities in the tables below do not agree to the balances in the statement of financial position as the

tables incorporate all contractual cash flows, on an undiscounted basis, relating to both principal and profit payments.

The maturity profile does not necessarily reflect behavioural cash flows.

on Less than 3 to 12 1 to 5 over 5

demand 3 months months years years Total

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Islamic business

2023

Non-derivative financial liabilities

Borrowings - - 176,097 1,443,202 - 1,619,299

Other liabilities 589,727 - - - - 589,727

Total financial liabilities 589,727 - 176,097 1,443,202 - 2,209,026