Page 251 - EXIM-Bank_Annual-Report-2023

P. 251

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 249

Notes to the fiNaNcial statemeNts

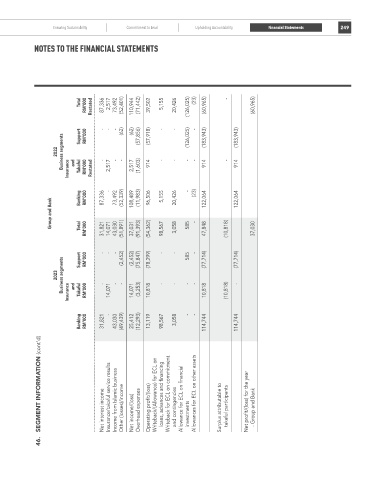

Total rM’000 restated 87,336 2,517 73,492 (52,401) 110,944 (71,442) 39,502 5,155 20,426 (126,025) (23) (60,965) - (60,965)

Business segments Insurance and Takaful rM’000 restated - 2,517 - - 2,517 (1,603) 914 - - - - 914 - 914

2022 Support rM’000 - - - (62) (62) (57,856) (57,918) - - (126,025) - (183,943) (183,943)

Banking rM’000 87,336 - 73,492 (52,339) 108,489 (11,983) 96,506 5,155 20,426 - (23) 122,064 122,064

Group and Bank Total rM’000 31,821 14,071 43,030 (51,891) 37,031 (91,393) (54,362) 98,567 3,058 585 - 47,848 (10,818) 37,030

Business segments Support rM’000 - - - (2,452) (2,452) (75,847) (78,299) - - 585 - (77,714) (77,714)

2023 Insurance and Takaful rM’000 - 14,071 - - 14,071 (3,253) 10,818 - - - - 10,818 (10,818) -

Banking rM’000 31,821 - 43,030 (49,439) 25,412 (12,293) 13,119 98,567 3,058 - - 114,744 114,744

SEGMENT INForMATIoN (cont’d) Net interest income Insurance/takaful service results Income from Islamic business Other (losses)/income Net income/(loss) Overhead expenses Operating profit/(loss) Writeback/(Allowance) for ECL on loans, advances and financing Writeback for ECL on commitment and contingencies Allowance for ECL on financial Allowances for ECL on other assets Surplus attributable to takaful participants Net profit/(loss) for the year - Grou

46. investments