Page 255 - EXIM-Bank_Annual-Report-2023

P. 255

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 253

Notes to the fiNaNcial statemeNts

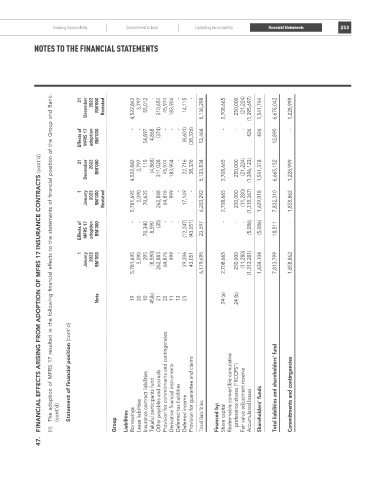

The adoption of MFRS 17 resulted in the following financial effects to the statements of financial position of the Group and Bank:

31 2022 - - -

December rM’000 restated 4,522,842 3,797 55,012 310,654 45,974 183,904 14,115 5,136,298 2,708,665 250,000 (21,224) (1,395,697) 1,541,744 6,678,042 1,228,999

Effects of MFRS 17 adoption rM’000 - - 54,897 4,868 (374) - - - (8,601) (38,326) 12,464 - - - 426 426 12,890 -

FINANCIAL EFFECTS ArISING FroM ADoPTIoN oF MFrS 17 INSurANCE CoNTrACTS (cont’d)

31 2022 3,797 115 (4,868) -

December rM’000 4,522,842 311,028 45,974 183,904 22,716 38,326 5,123,834 2,708,665 250,000 (21,224) (1,396,123) 1,541,318 6,665,152 1,228,999

1 - 999 - -

January 2022 rM’000 restated 5,781,695 5,090 70,635 262,848 64,876 17,149 6,203,292 2,708,665 250,000 (11,280) (1,318,367) 1,629,018 7,832,310 1,858,862

Effects of MFRS 17 adoption rM’000 - - 70,340 8,590 (35) - - - (12,247) (43,051) 23,597 - - - (5,086) (5,086) 18,511 -

January 2022 rM’000 5,781,695 5,090 (8,590) 262,883 64,876 29,396 43,051 6,179,695 2,708,665 250,000 (11,280) (1,313,281) 1,634,104 7,813,799 1,858,862

1 295 999 -

Note 24 (b)

19 20 10 45(k) 21 22 11 13 23 24 (a)

Statement of financial position (cont’d) Provision for commitments and contingencies Redeemable convertible cumulative Total liabilities and shareholders’ fund

(cont’d) Borrowings Lease liabilities Insurance contract liabilities Takaful participants fund Other payables and accruals Derivative financial instruments Deferred tax liabilities Deferred income Provision for guarantee and claims Total liabilities Financed by: Share capital preference shares (“RCCPS”) Fair value adjustment reserve Accumulated losses Shareholders’ funds Commitments and contingencies

(ii) Group Liabilities

47.