Page 257 - EXIM-Bank_Annual-Report-2023

P. 257

Management Discussion and Analysis Ensuring Sustainability Commitment to Lead Upholding Accountability Financial Statements 255

Notes to the fiNaNcial statemeNts

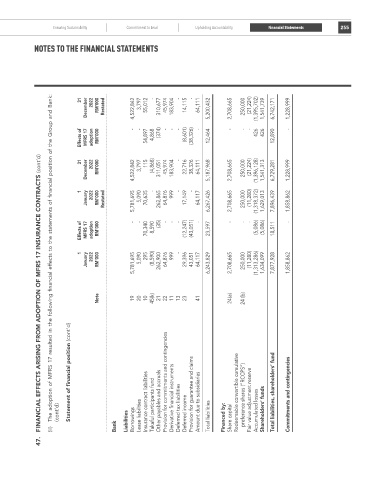

The adoption of MFRS 17 resulted in the following financial effects to the statements of financial position of the Group and Bank:

31 2022 - - -

December rM’000 restated 4,522,842 3,797 55,012 310,677 45,974 183,904 14,115 64,111 5,200,432 2,708,665 250,000 (21,224) (1,395,702) 1,541,739 6,742,171 1,228,999

Effects of MFRS 17 adoption rM’000 - - 54,897 4,868 (374) - - - (8,601) (38,326) - 12,464 - - - 426 426 12,890 -

FINANCIAL EFFECTS ArISING FroM ADoPTIoN oF MFrS 17 INSurANCE CoNTrACTS (cont’d)

31 2022 3,797 115 (4,868) -

December rM’000 4,522,842 311,051 45,974 183,904 22,716 38,326 64,111 5,187,968 2,708,665 250,000 (21,224) (1,396,128) 1,541,313 6,729,281 1,228,999

1 - 999 - -

January 2022 rM’000 restated 5,781,695 5,090 70,635 262,865 64,876 17,149 64,117 6,267,426 2,708,665 250,000 (11,280) (1,318,372) 1,629,013 7,896,439 1,858,862

Effects of MFRS 17 adoption rM’000 - - 70,340 8,590 (35) - - - (12,247) (43,051) - 23,597 - - - (5,086) (5,086) 18,511 -

January 2022 rM’000 5,781,695 5,090 (8,590) 262,900 64,876 29,396 43,051 64,117 6,243,829 2,708,665 250,000 (11,280) (1,313,286) 1,634,099 7,877,928 1,858,862

1 295 999 -

Note 24 (b)

19 20 10 45(k) 21 22 11 13 23 41 24(a)

Statement of financial position (cont’d) Provision for commitments and contingencies Redeemable convertible cumulative Total liabilities, shareholders’ fund

(cont’d) Borrowings Lease liabilities Insurance contract liabilities Takaful participants fund Other payables and accruals Derivative financial instruments Deferred tax liabilities Deferred income Provision for guarantee and claims Amount due to subsidiaries Total liabilities Financed by: Share capital preference shares (“RCCPS”) Fair value adjustment reserve Accumulated losses Shareholders’ funds Commitments and contingencies

(ii) Bank Liabilities

47.