Page 254 - EXIM-Bank_Annual-Report-2023

P. 254

EXIM BANk MALAySIA

252 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

Notes to the fiNaNcial statemeNts

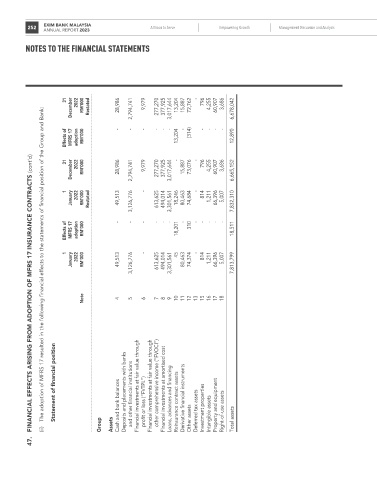

December rM’000 restated 28,986 2,794,741 9,979 277,270 377,925 3,017,644 13,204 15,887 72,762 4,255 60,907 6,678,042

31 2022 - 796 3,686

The adoption of MFRS 17 resulted in the following financial effects to the statements of financial position of the Group and Bank:

Effects of MFRS 17 adoption rM’000 - - - - - - 13,204 - (314) - - - - 12,890

FINANCIAL EFFECTS ArISING FroM ADoPTIoN oF MFrS 17 INSurANCE CoNTrACTS (cont’d)

31 2022 9,979 - - 796 4,255 3,686

December rM’000 28,986 2,794,741 277,270 377,925 3,017,644 15,887 73,076 60,907 6,665,152

1 - - 814

January 2022 rM’000 restated 49,513 3,126,776 613,625 494,014 3,301,561 18,246 80,463 74,684 1,211 66,396 5,007 7,832,310

Effects of MFRS 17 adoption rM’000 - - - - - - 18,201 - 310 - - - - - 18,511

January 2022 rM’000 49,513 3,126,776 613,625 494,014 3,301,561 80,463 74,374 1,211 66,396 5,007 7,813,799

1 - 45 - 814

Note

4 5 6 7 8 9 10 11 12 13 15 16 17 18

Statement of financial position Cash and bank balances Deposits and placements with banks and other financial institutions Financial investments at fair value through profit or loss (“FVTPL”) Financial investments at fair value through other comprehensive income (“FVOCI”) Financial investments at amortised cost Loans, advances and financing Reinsurance contract assets Derivative financial instruments Property and equipment

(ii) Group Assets Other assets Deferred tax assets Investment properties Intangible assets Right-of-use assets Total assets

47.