Page 6 - EXIM-Bank_Annual-Report-2023

P. 6

EXIM BANK MALAYSIA

4 A Vision to Serve Empowering Growth Management Discussion and Analysis

ANNUAL REPORT 2023

OVERVIEW OF OUR

BUSINESS OPERATIONS

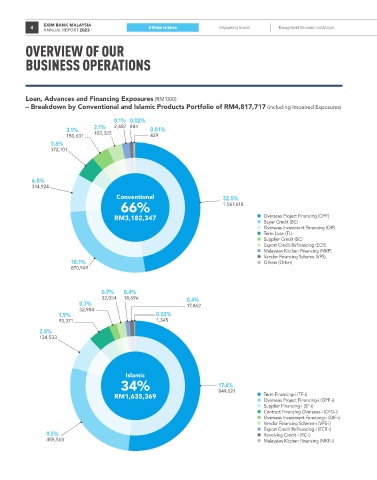

Loan, Advances and Financing Exposures (RM‘000)

– Breakdown by Conventional and Islamic Products Portfolio of RM4,817,717 (including Impaired Exposures)

0.1% 0.02%

2.1% 2,487 884

3.1% 0.01%

150,631 102,325 429

3.6%

172,101

6.5%

314,924

Conventional 32.5%

66% 1,567,618

RM3,182,347 Overseas Project Financing (OPF)

Buyer Credit (BC)

Overseas Investment Financing (OIF)

Term Loan (TL)

Supplier Credit (SC)

Export Credit Refinancing (ECR)

Malaysian Kitchen Financing (MKF)

Vendor Financing Scheme (VFS)

18.1% Others (Other)

870,949

0.7% 0.4%

32,054 18,696 0.4%

0.7% 17,862

32,984

1.9% 0.03%

93,371 1,345

2.8%

134,533

Islamic

34% 17.6%

RM1,635,369 849,021 Term Financing-i (TF-i)

Overseas Project Financing-i (OPF-i)

Supplier Financing-i (SF-i)

Contract Financing Overseas-i (CFO-i)

Overseas Investment Financing-i (OIF-i)

Vendor Financing Scheme-i (VFS-i)

Export Credit Refinancing-i (ECR-i)

9.5% Revolving Credit-i (RC-i)

455,503 Malaysian Kitchen Financing (MKF-i)